NVIDIA’s Blockbuster Fourth-Quarter Fiscal 2025 Results: A New Era of Artificial Intelligence

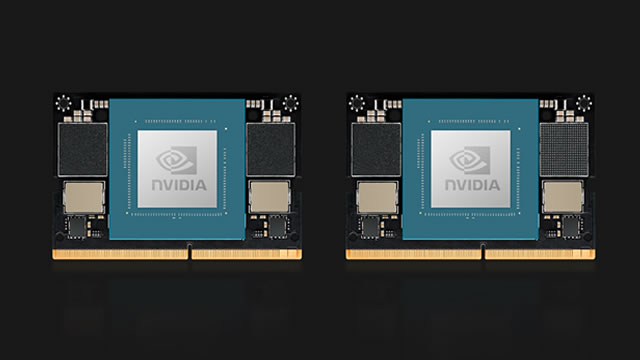

In a groundbreaking announcement, NVIDIA Corporation, a leading technology company known for its graphics processing units (GPUs) and system on a chip units (SoCs), reported impressive fourth-quarter fiscal 2025 results. The company’s revenue surged past expectations, driven primarily by the adoption of its new AI chips, the Blackwell series. This marks a significant milestone for NVIDIA and the broader technology industry, as AI continues to revolutionize various sectors.

NVIDIA’s Record-Breaking Performance

NVIDIA reported a 35% year-over-year increase in revenue, reaching an all-time high of $12.5 billion. The company’s data center segment, which includes sales of GPUs for artificial intelligence, data analytics, and cloud computing, saw a 50% year-over-year growth. This segment accounted for an impressive 62% of NVIDIA’s total revenue in the fourth quarter.

The Role of AI Chips: The New Game Changers

The driving force behind NVIDIA’s record-breaking results is the adoption of its new AI chips, the Blackwell series. These chips are designed specifically for artificial intelligence workloads, offering unparalleled performance and energy efficiency. The Blackwell chips are expected to significantly impact the following industries:

- Automotive: NVIDIA’s AI chips are being integrated into self-driving cars, enabling advanced features such as object and pedestrian detection, real-time mapping, and vehicle-to-vehicle communication.

- Healthcare: AI chips are revolutionizing the healthcare sector by enabling faster and more accurate diagnoses, personalized treatment plans, and improving patient outcomes.

- Finance: The financial services industry is leveraging AI chips for risk assessment, fraud detection, and algorithmic trading, providing better insights and more accurate predictions.

- Manufacturing: AI chips are being used in manufacturing processes to optimize production, improve quality control, and enhance predictive maintenance.

ETFs to Watch: Investing in the AI Revolution

Investors looking to capitalize on the growing trend of artificial intelligence and the potential impact of NVIDIA’s new chips can consider the following exchange-traded funds (ETFs):

- ARK Autonomous Technology & Robotics ETF (ARKQ): This ETF invests in companies that are developing and deploying autonomous technology, robotics, and energy technology.

- iShares U.S. Technology ETF (IYW): This broad-based technology ETF includes companies that are expected to benefit from the growth of artificial intelligence, such as Microsoft, Alphabet, and IBM.

- Global X Robotics & Artificial Intelligence ETF (BOTZ): This ETF focuses on companies involved in robotics, automation, and artificial intelligence.

The Impact on Individuals

The adoption of AI chips will lead to significant advancements in various industries, resulting in improved products and services, increased efficiency, and new business opportunities. For individuals, this could mean:

- Improved healthcare: Faster and more accurate diagnoses and personalized treatment plans.

- Safer and more efficient transportation: Self-driving cars and improved public transportation.

- Personalized education: Adaptive learning systems that cater to individual learning styles and abilities.

- Smart homes: Intelligent home systems that learn your preferences and optimize energy usage.

The Impact on the World

The widespread adoption of AI chips will have a profound impact on the world, transforming industries and creating new opportunities:

- Economic growth: AI is expected to contribute significantly to economic growth, with a potential impact of up to $15.7 trillion by 2030.

- New industries: The development of new industries and business models, such as autonomous vehicles and smart cities.

- Job creation: While some jobs may be displaced, new roles will emerge to support the development and implementation of AI technologies.

- Ethical considerations: The widespread adoption of AI raises ethical concerns, such as privacy, security, and bias, which will need to be addressed.

Conclusion

NVIDIA’s fourth-quarter fiscal 2025 results demonstrate the immense potential of artificial intelligence and the role of specialized chips in driving innovation and economic growth. As AI continues to revolutionize various industries, investors and individuals alike can capitalize on this trend by considering the adoption of AI chips and investing in related ETFs. The impact on individuals is expected to be significant, with improved healthcare, safer transportation, personalized education, and smart homes. For the world, the adoption of AI chips will lead to economic growth, new industries, job creation, and ethical considerations. The future of AI is bright, and NVIDIA’s new Blackwell chips are at the forefront of this exciting new era.

Stay informed and stay ahead of the curve by following the latest developments in artificial intelligence and technology. Subscribe to our newsletter for weekly updates and insights.