Nvidia’s Slumping Shares: A Closer Look

On Thursday, shares of Nvidia (NVDA) took a significant hit, plunging over 8% in value. This decline came a day after the company reported its quarterly earnings, which showed a slight miss on revenue expectations. Despite this setback, Nvidia remains the second most valuable tech company in the United States, with a market capitalization that still hovers around the $2.9 trillion mark.

Nvidia’s Earnings Report

Nvidia reported earnings of $1.14 per share, which was in line with analysts’ expectations. However, the company’s revenue came in at $7.16 billion, which was slightly below the anticipated $7.18 billion. The miss on revenue expectations was attributed to lower-than-anticipated sales in the gaming segment, which accounts for a significant portion of Nvidia’s revenue.

Impact on Individual Investors

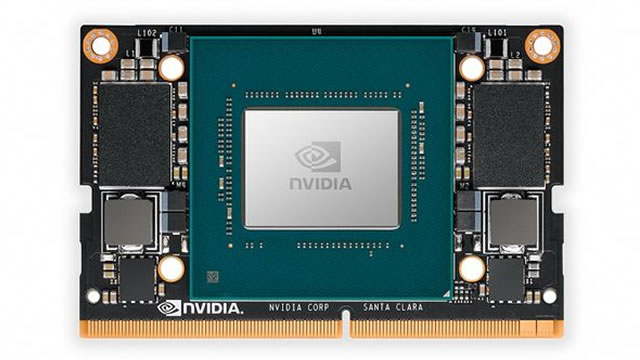

For individual investors who own Nvidia stock, this decline in share price may be concerning. However, it’s important to remember that short-term market fluctuations are a normal part of investing. Nvidia has a strong track record of innovation and growth, and its market position as a leader in graphics processing units (GPUs) and artificial intelligence (AI) is unlikely to change anytime soon.

- Long-term investors may view this as an opportunity to buy more shares at a lower price.

- Those with a shorter investment horizon may consider holding off on purchasing new shares until the market stabilizes.

- Investors should keep an eye on future earnings reports and company news to gauge the impact of this earnings miss on Nvidia’s stock price.

Impact on the World

Nvidia’s decline in share price may have broader implications for the tech industry and the economy as a whole. Here are a few potential ways this could play out:

- Decreased investor confidence in the tech sector, which could lead to a broader market correction.

- A ripple effect on other tech companies that rely on Nvidia for components or partnerships.

- An impact on Nvidia’s employees and suppliers, who may be affected by potential layoffs or reduced orders.

Conclusion

Nvidia’s 8% decline in share price following its earnings report is a reminder that even the most successful companies can experience market fluctuations. However, it’s important for investors to keep a long-term perspective and focus on the company’s underlying strengths. Nvidia’s position as a leader in GPUs and AI is unlikely to change, and the company continues to innovate and expand into new markets. For the broader economy, the impact of Nvidia’s earnings miss remains to be seen, but it’s a reminder of the importance of diversification and a long-term investment horizon.

As always, it’s important for individual investors to do their own research and consult with financial professionals before making any investment decisions.