Affordable Tech Stocks: A Closer Look at Micron, Super Micro, and Workday

In the ever-evolving world of technology, identifying undervalued stocks can be a goldmine for investors. While the tech sector is known for its high-flyers, there are several stocks trading at relatively low valuations to their historical levels. In this blog post, we’ll delve deeper into three such stocks: Micron Technology, Inc. (MU), Super Micro Computer, Inc. (SMCI), and Workday, Inc. (WDAY).

Micron Technology, Inc. (MU)

Micron Technology is a leading global manufacturer and provider of semiconductor solutions. The company’s portfolio includes memory and storage solutions for computing, consumer, networking, industrial, and automotive markets. With a market capitalization of around $55 billion, Micron’s stock has seen a significant decline from its highs in 2018. However, the company has been making strides in the memory market, particularly in the DRAM and NAND segments.

Micron’s financials show a strong balance sheet, with a cash position of over $8 billion and minimal debt. The company’s revenue for Q1 2023 was $7.9 billion, a 34% YoY increase. The company’s gross margin also improved to 33.4%, up from 31.5% in the same quarter last year. These improvements indicate that Micron is well-positioned to capitalize on the growing demand for memory solutions in the tech industry.

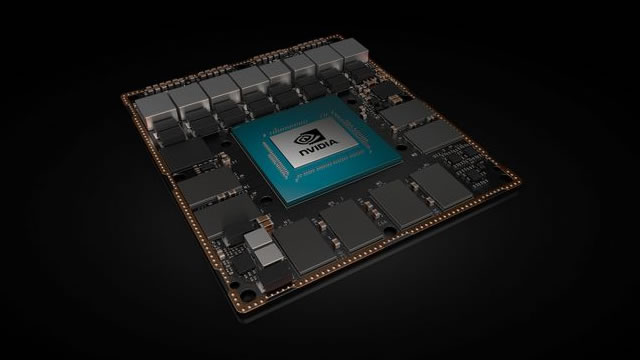

Super Micro Computer, Inc. (SMCI)

Super Micro Computer is a leading innovator in high-performance, high-efficiency server technology. The company’s products are designed to deliver the highest levels of computing power, energy efficiency, and flexibility. With a market capitalization of around $3 billion, Super Micro’s stock has seen a decline in the past year, providing an opportunity for value investors. The company’s revenue for Q1 2023 was $624 million, a 12% YoY decrease. However, the company’s gross margin improved to 21.1%, up from 19.9% in the same quarter last year.

Super Micro’s financials reveal a solid balance sheet, with a cash position of over $400 million and minimal debt. The company’s strong position in the server market, coupled with its focus on energy efficiency, positions it well to capitalize on the growing demand for data center infrastructure. The decline in stock price presents an attractive entry point for investors seeking value in the tech sector.

Workday, Inc. (WDAY)

Workday is a leading provider of enterprise cloud applications for finance and human resources. The company’s solutions are designed to streamline business processes and improve operational efficiency. With a market capitalization of around $80 billion, Workday’s stock has seen a decline from its highs in 2021. However, the company’s revenue for Q1 2023 was $1.3 billion, a 21% YoY increase. The company’s gross margin also improved to 74.6%, up from 72.6% in the same quarter last year.

Workday’s financials show a strong balance sheet, with a cash position of over $3 billion and minimal debt. The company’s focus on enterprise cloud solutions positions it well to capitalize on the growing trend towards cloud computing. The decline in stock price presents an attractive entry point for investors seeking growth in the tech sector.

Impact on Individual Investors

For individual investors, the decline in these stocks presents an opportunity to invest in undervalued companies with strong fundamentals. By investing in Micron, Super Micro, and Workday, investors can gain exposure to the technology sector while benefiting from potential upside as the market recognizes the value of these companies. Additionally, these stocks offer a diverse range of exposure to different segments of the tech industry, from memory solutions to server technology to enterprise cloud applications.

Impact on the World

The impact of these stocks on the world extends beyond individual investors. The technology sector is a key driver of economic growth and innovation. By investing in undervalued stocks like Micron, Super Micro, and Workday, investors are providing these companies with the capital they need to continue innovating and growing. This, in turn, can lead to new technologies, improved efficiencies, and increased productivity.

Conclusion

In conclusion, the technology sector is home to a number of undervalued stocks, including Micron Technology, Super Micro Computer, and Workday. These companies offer strong fundamentals, attractive valuations, and diverse exposure to different segments of the tech industry. For individual investors, investing in these stocks presents an opportunity to gain exposure to the tech sector while benefiting from potential upside. For the world, investing in these stocks can provide the capital needed to drive innovation, improve efficiencies, and fuel economic growth.

- Micron Technology: A leading global manufacturer and provider of semiconductor solutions

- Super Micro Computer: A leading innovator in high-performance, high-efficiency server technology

- Workday: A leading provider of enterprise cloud applications for finance and human resources

- Strong fundamentals: Solid balance sheets, improving financials, and well-positioned to capitalize on industry trends

- Diverse exposure: Offering exposure to different segments of the tech industry

- Opportunity for individual investors: Undervalued stocks with potential for upside

- Impact on the world: Providing capital for innovation, improving efficiencies, and fueling economic growth