Unlocking the Potential of Freeport-McMoRan (FCX): A Comprehensive Analysis

Lately, there has been a significant surge in interest from Zacks.com users regarding Freeport-McMoRan Inc. (FCX), an international mining company. In today’s blog post, we will delve deeper into the facts that could shape the future of this intriguing stock.

Business Overview

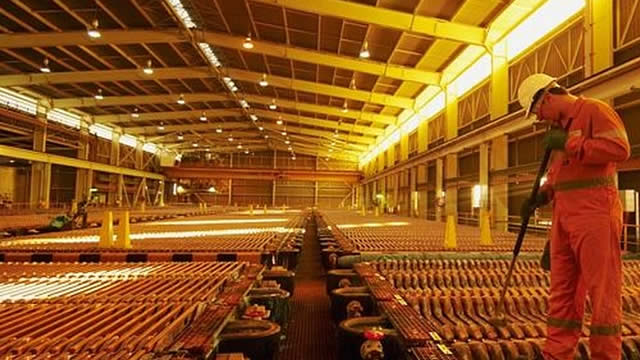

Freeport-McMoRan is a leading international mining company with a diverse portfolio of assets in copper, gold, and molybdenum. The company operates large, long-lived, geographically diverse assets, with significant proven and probable reserves of mineral deposits. FCX’s primary business consists of the exploration, production, and sale of copper, gold, and molybdenum.

Financial Performance

In the last reported quarter, Freeport-McMoRan’s revenues came in at $5.9 billion, marking a 27% increase compared to the same period last year. This growth was primarily driven by higher copper prices and increased production volumes. The company’s net income for the quarter was $1.1 billion, a significant improvement from the net loss reported in the same quarter a year ago. These financial figures demonstrate the company’s resilience and ability to weather market fluctuations.

Operations and Expansion

Freeport-McMoRan’s operations span across various countries, including the United States, Indonesia, and Peru. The company’s major projects include the Grasberg mine in Indonesia, which is one of the world’s largest gold and copper mines, and the Morenci mine in Arizona, which is the largest copper mine in North America. FCX is also investing in several expansion projects, such as the El Abra copper mine in Chile and the Cerro Verde copper mine in Peru.

Market Dynamics

The copper market, a significant component of Freeport-McMoRan’s business, has been experiencing a bullish trend due to a variety of factors. These include increasing demand from the electric vehicle industry, as copper is essential for the production of batteries, and supply constraints resulting from geopolitical issues and mine closures.

Impact on Individuals

- Investors: The strong financial performance and expansion plans of Freeport-McMoRan make it an attractive investment opportunity for those seeking exposure to the mining sector and commodities.

- Consumers: The growing demand for copper, driven by the electric vehicle industry, could lead to increased prices for copper-based goods and services, potentially impacting consumers.

Impact on the World

- Economy: The copper industry plays a crucial role in the global economy, with significant implications for trade, employment, and economic growth.

- Environment: Mining operations, particularly those involving copper, can have adverse environmental impacts, including water pollution and land degradation.

Conclusion

Freeport-McMoRan’s robust financial performance, diverse operations, and expansion plans position the company well for the future. However, the potential impact on individuals and the world at large, particularly in terms of environmental concerns and economic implications, should not be overlooked. As always, it is essential to consider these factors when making investment decisions or assessing the broader implications of the mining industry.

Stay informed and make knowledgeable decisions – keep exploring the world of investing with us!