Bunker Hill Mining Corp. and Sprott Streaming Amend Royalty Agreement: A Detailed Explanation

On February 25, 2025, Bunker Hill Mining Corp. (BNKR, BHLL), a mining company based in Kellogg, Idaho, and Vancouver, British Columbia, announced an amendment to its existing royalty agreement with Sprott Private Resource Streaming & Royalty Corp. (Sprott Streaming). This agreement, which was originally signed on June 23, 2023, has been updated with a first amendment (the “First Amendment”) as of December 12, 2024.

Background of the Existing Royalty Agreement

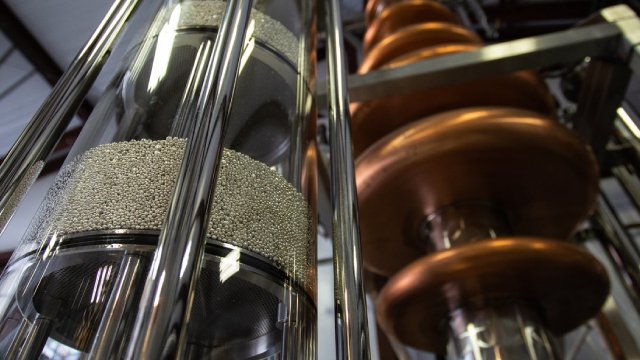

The Existing Royalty Agreement granted Sprott Streaming a 2.5% net smelter return (NSR) royalty on the production of silver, gold, lead, zinc, and other metals from the Bunker Hill Mine. The mine is located in the Silver Valley district in Shoshone County, Idaho. The agreement also provided Sprott Streaming with certain rights to purchase additional royalties on the mine’s production at certain prices.

Key Provisions of the First Amendment

The First Amendment makes several changes to the Existing Royalty Agreement:

- Reduction in Royalty Rate: The royalty rate for Sprott Streaming has been reduced from 2.5% to 1.5% on the first 1,000 tonnes of ore processed per day.

- Capped Royalty Payments: The maximum annual royalty payments to Sprott Streaming have been capped at $10 million.

- Royalty Buyback Option: Bunker Hill has the option to repurchase the royalty for a price of $35 million, which can be paid in cash or common shares of Bunker Hill.

Impact on Bunker Hill Mining Corp.

The amended agreement is expected to provide Bunker Hill with significant cost savings. With the reduced royalty rate and capped payments, the company will have more financial flexibility to invest in mine operations and exploration activities.

Additionally, the royalty buyback option could potentially provide Bunker Hill with an attractive exit strategy for the royalty. If the company decides to exercise this option, it could reduce its ongoing royalty payments and potentially increase shareholder value.

Impact on the Mining Industry and Investors

The amended agreement between Bunker Hill and Sprott Streaming is a significant development in the mining industry. It highlights the growing trend of resource streaming and royalty companies as alternative sources of financing for mining projects.

For investors, this trend presents both opportunities and risks. On the one hand, resource streaming and royalty companies can provide exposure to commodity prices without the operational risks associated with mining companies. On the other hand, the potential for royalty buybacks and other amendments to existing agreements can impact the long-term cash flows of these companies.

Conclusion

The amendment to the royalty agreement between Bunker Hill Mining Corp. and Sprott Streaming is a positive development for both parties. It provides Bunker Hill with cost savings and financial flexibility, while also potentially increasing shareholder value through the royalty buyback option. For the mining industry and investors, this agreement highlights the growing importance of resource streaming and royalty companies as alternative sources of financing for mining projects.

As the mining industry continues to evolve, it will be important for companies and investors to stay informed about the latest trends and developments. By understanding the implications of agreements like the one between Bunker Hill and Sprott Streaming, investors can make informed decisions and capitalize on opportunities in the mining sector.