Deribit’s $5 Billion Expiration Event: A Cautionary Tale

Deribit’s $5 Billion Expiration Event: A Cautionary Tale

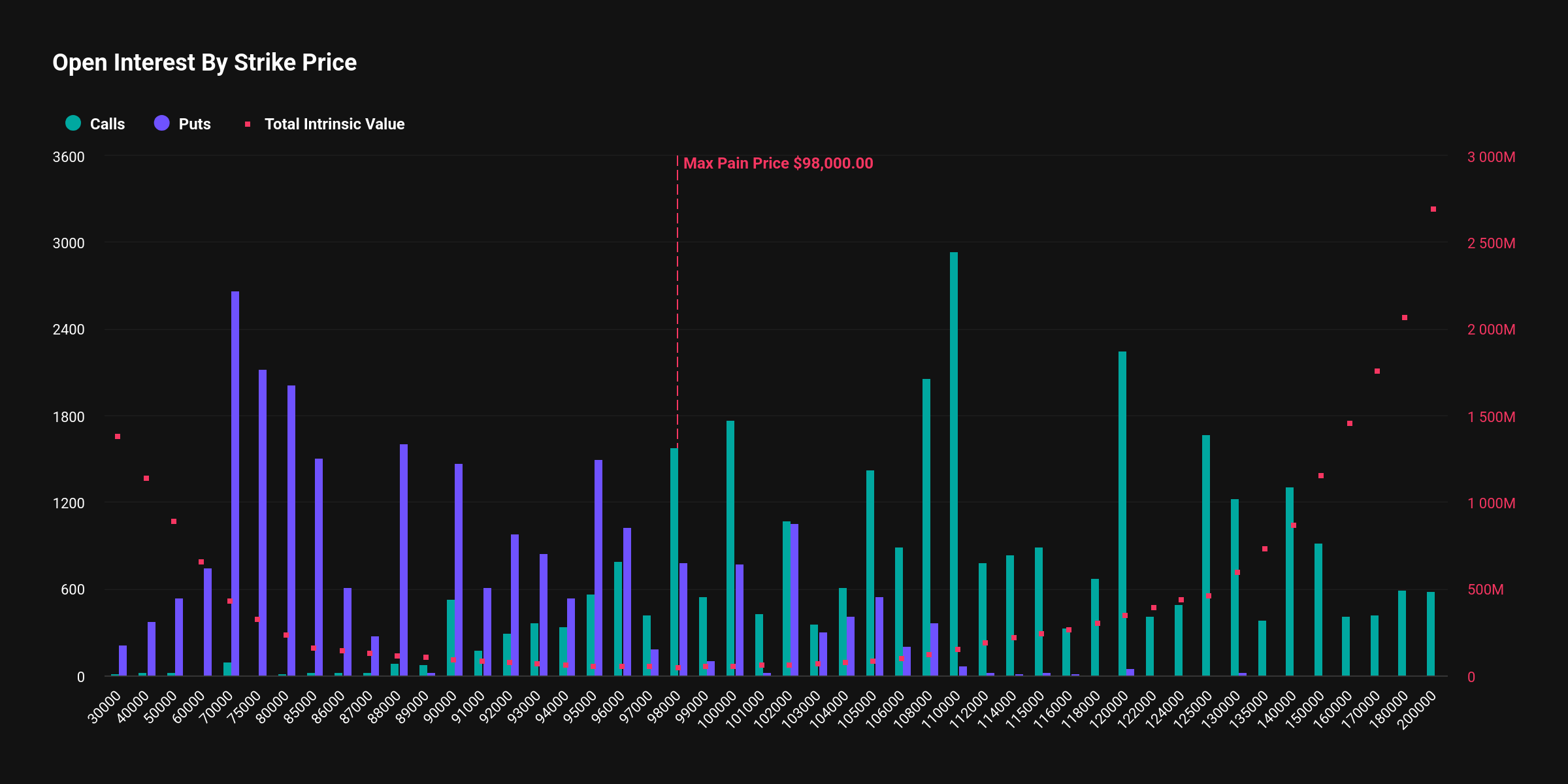

Oh, hello there, curious human! Today, we’re going to delve into the fascinating world of derivatives and the upcoming expiration event on Deribit, a popular cryptocurrency derivatives exchange. Buckle up, as we explore the potential implications of over $5 billion notional value set to expire this Friday at 08:00 UTC.

A Quick Derivatives Primer

Before we dive into the specifics of the Deribit event, let’s discuss what derivatives are and how they work. Derivatives are financial securities with values that are derived from an underlying asset. In our case, that asset is cryptocurrencies. Derivatives can be used for various purposes, such as hedging risk, speculating on price movements, or generating income.

The Expiration Event: What’s Happening on Deribit

Every derivative contract has an expiration date. This is the date when the contract expires and is no longer active. When a contract expires, the holder must either offset their position by entering into an opposite trade or take delivery of the underlying asset. In the case of Deribit, the underlying asset is Bitcoin.

Now, you might be wondering, “Why would anyone let their contract expire without taking action?” Well, there are a few reasons. For one, some traders may believe that the price of Bitcoin will not change significantly before expiration, making it unnecessary to offset their position. Others may be holding a long position and hoping for a price increase before expiration, in which case they can profit from the difference between the contract price and the market price. However, there is also a risk that the price could move against them, resulting in a loss.

The Potential Impact on Individuals

So, what does this mean for individuals? Well, if you hold open positions on Deribit, you’ll want to closely monitor the price of Bitcoin leading up to expiration. A large price movement in either direction could significantly impact your potential profit or loss. Additionally, if you’re considering entering into a new derivative contract, be aware that expiration events can cause increased volatility and potentially larger bid-ask spreads.

The Global Implications

The expiration event on Deribit is not just an isolated occurrence. It can have broader implications for the cryptocurrency market as a whole. For instance, large moves in the price of Bitcoin could lead to increased volatility and uncertainty in the market. Furthermore, if a significant number of contracts are not offset before expiration, it could lead to a surge in demand for Bitcoin as holders look to take delivery of the underlying asset.

Additionally, the expiration event could potentially impact other markets as well. For example, if the price of Bitcoin moves significantly, it could have ripple effects on other cryptocurrencies, as well as traditional financial markets. As such, it’s important for investors to keep a close eye on the situation and consider how it might impact their overall investment strategies.

Conclusion: Stay Informed and Prepare

In conclusion, the upcoming expiration event on Deribit, with over $5 billion notional value set to expire, is a fascinating occurrence that highlights the unique challenges and opportunities presented by cryptocurrency derivatives. As an individual investor, it’s essential to stay informed and prepare for potential price movements. And, for those considering entering into new derivative contracts, be aware of the expiration dates and the potential implications for the underlying asset. Remember, knowledge is power, and in the world of derivatives, it’s crucial to stay one step ahead!

- Keep an eye on the price of Bitcoin leading up to expiration

- Consider the potential impact on your investment strategy

- Stay informed about the broader implications for the cryptocurrency market

Deribit’s $5 Billion Expiration Event: A Cautionary Tale

Deribit’s $5 Billion Expiration Event: A Cautionary Tale