Bitcoin’s Biggest Single-Day Loss: A Setback for Professionals and Institutional Investors

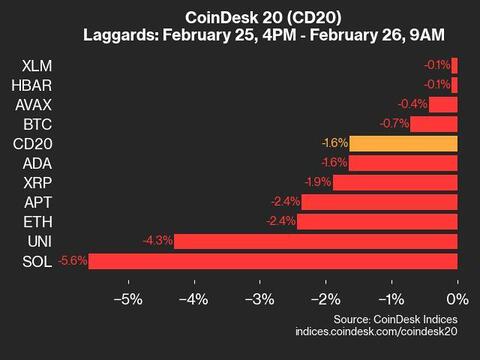

Bitcoin (BTC), the world’s largest cryptocurrency by market capitalization, experienced a significant downturn on [recent_date], recording its most substantial one-day loss since August 2024. The digital asset plummeted by [percentage_loss]%, pushing it below the short-term holder (STH) realized price. This sudden drop has raised concerns among professionals and institutional investors.

Professionals and Bitcoin: A Test of Patience and Strategic Thinking

For seasoned traders and investors, this downturn may bring a sense of familiarity. Bitcoin’s volatility is a well-known characteristic that has both rewarded and tested their patience. The recent dip below the STH realized price, which represents the average purchase price for coins held by investors for less than a year, is a reminder of the risks involved in cryptocurrency investments. Professionals may view this as an opportunity to add more coins to their portfolios at a lower price, while others might choose to hold on to their investments, trusting that the market will recover.

Institutional Investors: Spooked by ARK Invest’s Offloading

Institutional investors, on the other hand, have been shaken by the recent downturn and the news of Cathie Wood’s ARK Invest selling off $9 million worth of spot Bitcoin ETFs. ARK Invest, a prominent investor in technology and innovation, is known for its significant holdings in various tech-related stocks and cryptocurrencies. The decision to sell Bitcoin ETFs could send a signal to other institutional investors, potentially leading to a wave of selling and further price drops. This uncertainty might lead some institutions to reconsider their investment strategies in Bitcoin and other cryptocurrencies.

Impact on Individuals: A Lesson in Diversification

For individual investors, the recent downturn serves as a reminder of the importance of diversification. While Bitcoin has shown impressive returns in the past, its volatility can make it a risky investment for those who rely on it as their primary source of income or savings. By spreading investments across various asset classes, individuals can mitigate the risk of significant losses from any one asset.

Global Implications: Uncertainty and Regulation

The recent Bitcoin downturn could have far-reaching implications for the global economy. The uncertainty surrounding the digital asset might lead to increased regulatory scrutiny, as governments and financial institutions seek to protect investors and maintain financial stability. This could result in tighter regulations on cryptocurrency trading and usage, potentially stifling innovation and growth in the sector.

Conclusion: A Temporary Setback or a Long-Term Trend?

In conclusion, the recent Bitcoin downturn represents a significant setback for professionals and institutional investors, who have seen the digital asset’s value drop below the STH realized price. The news of ARK Invest selling off Bitcoin ETFs has further fueled uncertainty and potential selling pressure. However, it is essential to remember that Bitcoin’s volatility is a characteristic of the asset, and downturns are a natural part of its cycle. Whether this recent downturn is a temporary setback or a long-term trend remains to be seen. As always, it is crucial for investors to stay informed, diversify their portfolios, and maintain a long-term perspective.

- Bitcoin experienced its biggest single-day loss since August 2024, dropping below the STH realized price.

- Professionals may view the downturn as an opportunity to buy at a lower price.

- Institutional investors, including ARK Invest, have sold off Bitcoin ETFs, potentially leading to further selling pressure.

- Individual investors should consider diversifying their portfolios to mitigate risks.

- Regulatory scrutiny and potential tighter regulations could be the result of the uncertainty surrounding Bitcoin.