Exploring the Future of APTV: A Closer Look at APTIV HLDS Ltd.

APTIV HLDS Ltd. (APTV), formerly known as Delphi Technologies, has been a stock that has piqued the interest of many investors and traders on Zacks.com. With its strong presence in the automotive technology industry, APTV has been able to adapt to the rapidly changing market and maintain a steady growth trajectory.

Background and Business Overview

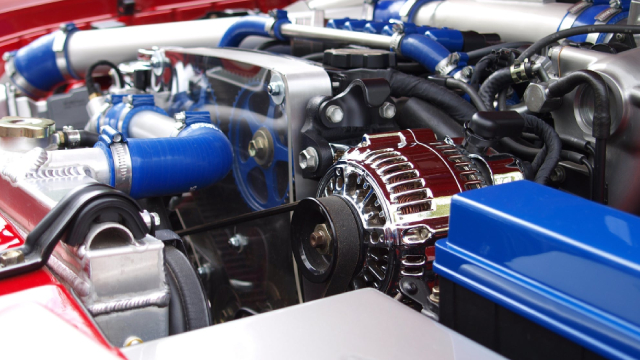

APTV is a leading global technology company that provides innovative solutions for the automotive and commercial vehicle markets. The company’s product portfolio includes powertrain systems, electronics, and engineering services. APTV’s customers are major automakers and commercial vehicle manufacturers, making it a crucial supplier in the industry.

Recent Developments and Financial Performance

In recent years, APTV has made significant strides in the electric vehicle (EV) market. The company has expanded its electric propulsion systems and battery technology capabilities, positioning itself to capitalize on the growing demand for EVs. In its Q3 2021 earnings report, APTV reported a 27% increase in revenue year-over-year, driven by strong growth in its powertrain and electronics segments.

Impact on Individual Investors

For individual investors, the continued growth of APTV could present an opportunity for significant returns. The company’s strong financial performance and strategic focus on the EV market make it a compelling investment option. Moreover, APTV’s diverse product portfolio and customer base provide a level of stability that can help mitigate the risks associated with investing in a single stock.

Impact on the World

On a larger scale, the growth of APTV and other companies in the automotive technology sector can have a significant impact on the world. The transition to electric vehicles is a crucial step in reducing greenhouse gas emissions and mitigating the effects of climate change. APTV’s role as a supplier of EV technology solutions makes it a key player in this transition.

Future Outlook

Looking ahead, APTV’s focus on the EV market and its strong financial performance suggest that the company is well-positioned for continued growth. However, there are challenges that the company and the industry as a whole must address, such as increasing competition and supply chain disruptions. Nevertheless, APTV’s innovative solutions and strategic partnerships give it a competitive edge and the ability to navigate these challenges.

Conclusion

APTV’s strong financial performance, strategic focus on the EV market, and diverse product portfolio make it an attractive investment option for individual investors. Moreover, the company’s role in the transition to electric vehicles and its contribution to reducing greenhouse gas emissions make it an important player in the global effort to address climate change. With a solid foundation and a clear vision for the future, APTV is poised to continue driving innovation and growth in the automotive technology industry.

- APTV is a leading global technology company that provides innovative solutions for the automotive and commercial vehicle markets.

- The company’s product portfolio includes powertrain systems, electronics, and engineering services.

- APTV has made significant strides in the electric vehicle (EV) market and reported a 27% increase in revenue year-over-year in Q3 2021.

- The growth of APTV and other companies in the automotive technology sector can have a significant impact on the world, contributing to the transition to electric vehicles and reducing greenhouse gas emissions.

- APTV’s focus on the EV market and its strong financial performance make it an attractive investment option for individual investors.