Douglas Dynamics (PLOW) Surpasses Earnings Estimates for Q1

In a noteworthy development, Douglas Dynamics, Inc. (PLOW) reported impressive earnings for the first quarter of 2023. The company managed to deliver earnings of $0.39 per share, surpassing the Zacks Consensus Estimate of $0.37 per share. This significant beat represents a substantial improvement compared to the earnings of $0.19 per share reported in the same quarter last year.

Company Overview

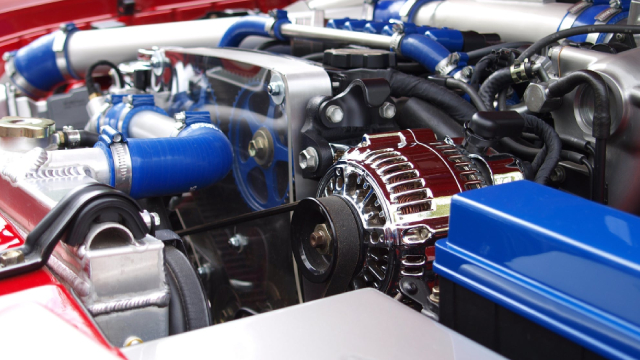

Douglas Dynamics is a leading manufacturer and upfitter of commercial work truck equipment. The company specializes in the design, manufacture, and distribution of plows, spreaders, and other truck attachments. Douglas Dynamics’ products cater to various industries, including construction, maintenance, energy, and government, among others.

Financial Performance

The impressive earnings performance for Q1 2023 can be attributed to several factors. First, the company’s revenue for the quarter increased by 32.5% year over year, reaching $217.7 million. This growth can be attributed to higher sales volumes in the Plows & Equipment segment and the acquisition of SnowDog, which was completed in Q4 2022.

Impact on Individual Investors

For individual investors, Douglas Dynamics’ strong earnings report is a positive sign. The company’s ability to beat earnings estimates indicates solid financial health and growing profitability. As a result, the stock price is likely to react favorably, potentially leading to increased investor interest and higher stock prices.

- Strong earnings report indicates financial health and profitability

- Positive reaction from investors, potentially leading to increased interest and higher stock prices

Impact on the World

Beyond the financial implications for investors, Douglas Dynamics’ earnings report also has broader implications for the economy and the world at large. The company’s growth can be seen as a sign of a thriving construction and maintenance industry, which is essential for infrastructure development and maintenance.

- Indicates a thriving construction and maintenance industry

- Contributes to infrastructure development and maintenance

Conclusion

In conclusion, Douglas Dynamics’ impressive earnings report for Q1 2023 is a positive sign for individual investors and the broader economy. The company’s solid financial health and growing profitability are likely to lead to increased investor interest and higher stock prices. Additionally, the growth of the construction and maintenance industry, as evidenced by Douglas Dynamics’ earnings, is essential for infrastructure development and maintenance, contributing to the overall health and prosperity of the global economy.

As we look forward, Douglas Dynamics’ continued growth and success are likely to be shaped by various factors, including market conditions, economic trends, and competitive dynamics. Nonetheless, the strong foundation laid by this impressive earnings report bodes well for the company’s future.