Bitcoin Takes a Hit: A Three-Month Low

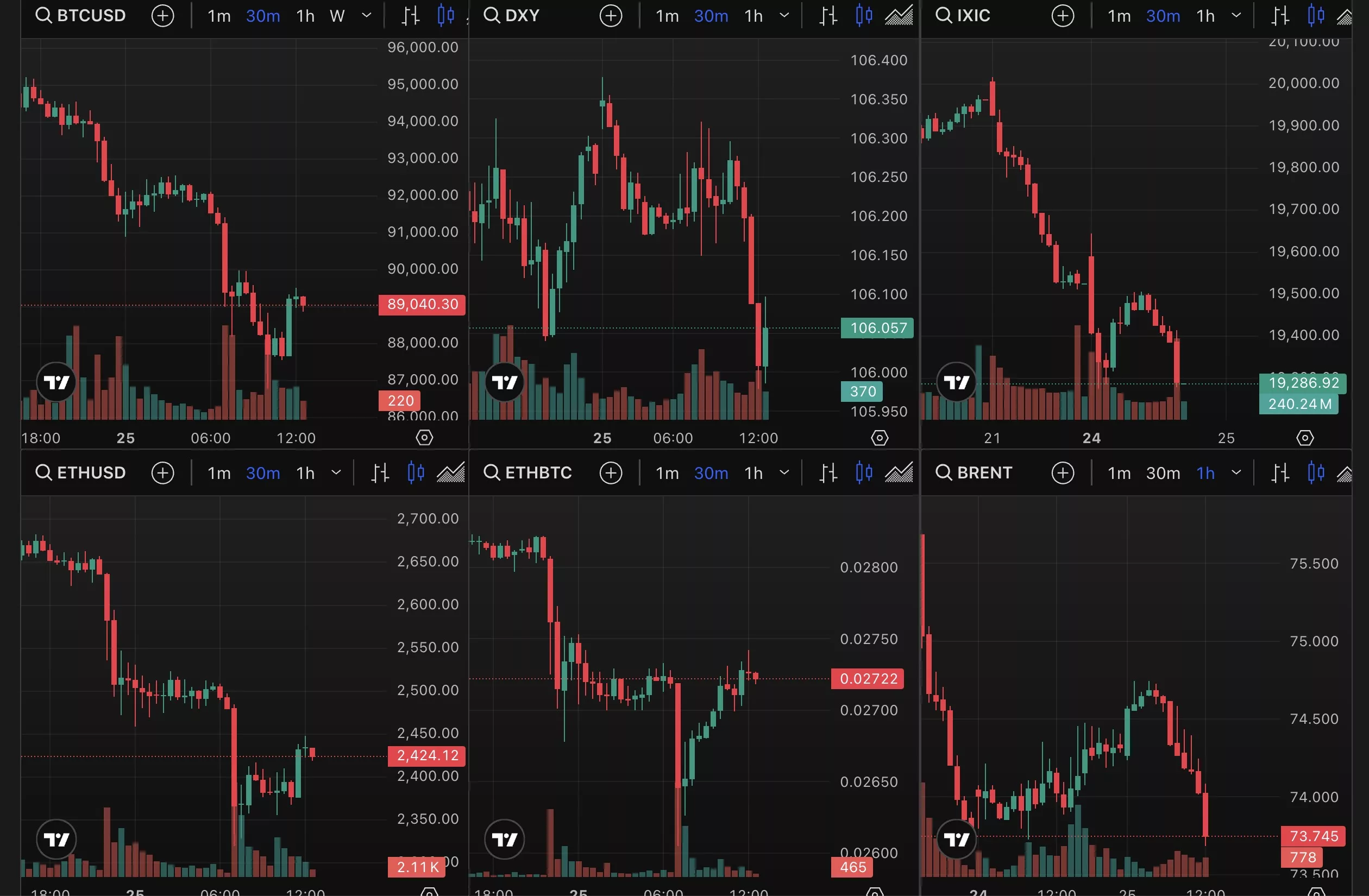

On Tuesday, the cryptocurrency market experienced a significant downturn, with Bitcoin taking the brunt of the damage. The digital currency plunged to its lowest level in three months, reaching a price of US$88,289. This marked a 3.5% decrease from its previous day’s closing price.

Economic Concerns and Risk Aversion

Analysts attributed the drop in Bitcoin’s value to lingering concerns regarding the US economy and a “risk off” attitude among investors. The ongoing trade tensions between the US and China, as well as the uncertainty surrounding the outcome of Brexit negotiations, have contributed to a general sense of unease in financial markets.

A Look Back: Mid-November 2020

It is important to note that Bitcoin’s current price level brings it back to where it was in mid-November 2020. At that time, the crypto market saw a surge in value following the US presidential election. The election of Joe Biden was seen as a positive event for the market, as many investors believed his administration would be more market-friendly than that of Donald Trump.

Impact on Individual Investors

For individual investors holding Bitcoin, this price dip may bring about feelings of anxiety and uncertainty. Those who have recently entered the market may be considering selling their holdings to minimize their losses. However, it is essential to remember that the crypto market is known for its volatility, and prices can fluctuate significantly in both directions.

- Consider holding onto your Bitcoin and observing the market trends.

- Diversify your investment portfolio to minimize risk.

- Keep an eye on market news and analyst predictions.

Global Implications

The decline in Bitcoin’s value could have far-reaching consequences for the global economy. As more institutions and individuals adopt Bitcoin and other cryptocurrencies, their performance can significantly impact financial markets and traditional currencies.

- Central banks and governments may reconsider their stance on cryptocurrencies.

- Traditional financial institutions may increase their offerings related to digital currencies.

- The crypto market could experience further volatility as investors react to economic and political developments.

Conclusion

The recent decline in Bitcoin’s value to a three-month low has left many investors feeling uneasy. However, it is essential to remember that the crypto market is known for its volatility, and prices can fluctuate significantly. Individual investors should consider holding onto their Bitcoin, diversifying their portfolios, and staying informed about market trends. On a larger scale, the global implications of this price dip could include increased scrutiny from governments and central banks and further volatility in the crypto market.

As always, it is crucial to approach investments with a well-informed and cautious mindset. Keeping abreast of market news and seeking the advice of financial professionals can help minimize risk and maximize potential rewards.