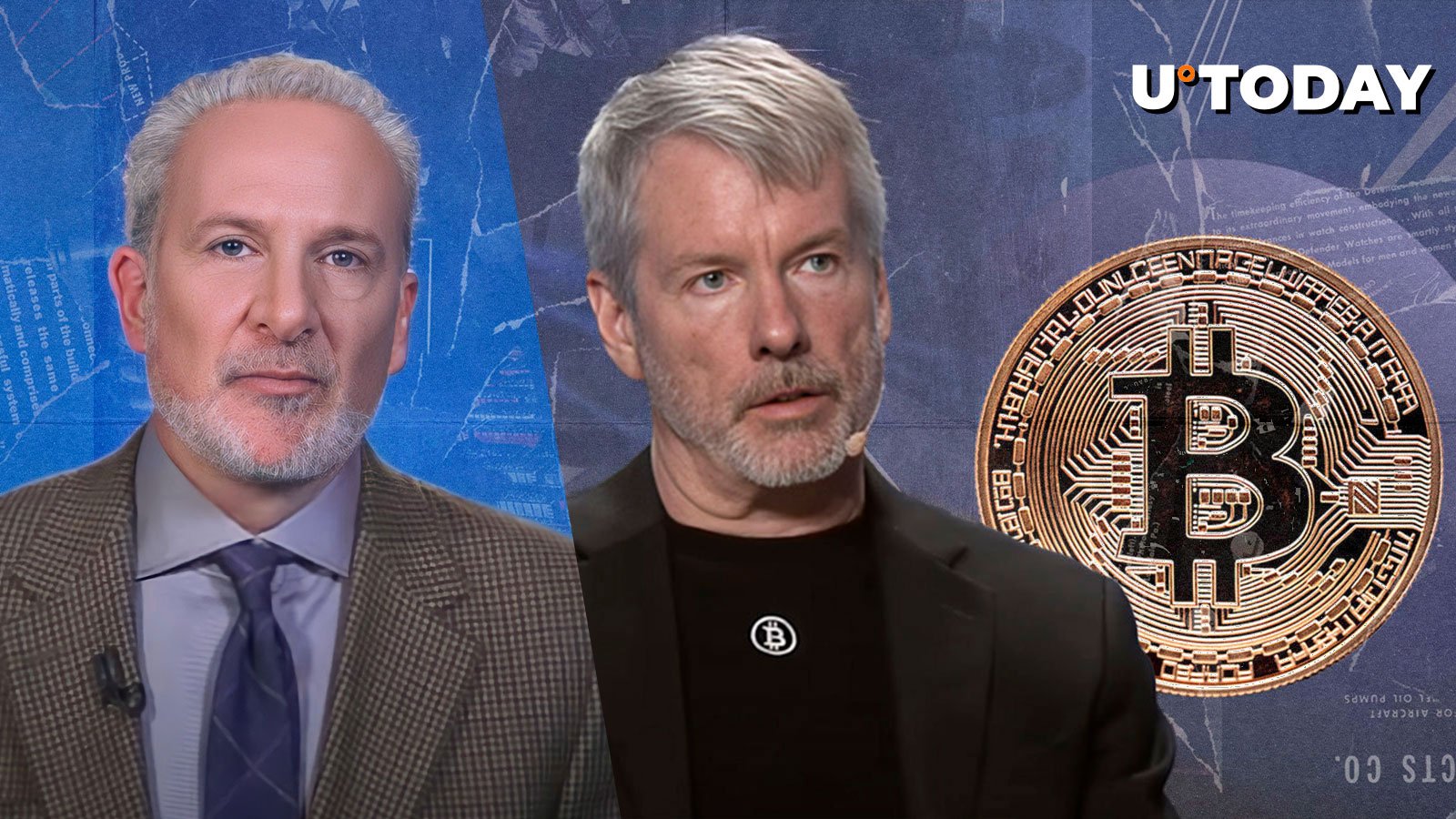

Peter Schiff’s Unwavering Criticism of Bitcoin: Current Perspective

Peter Schiff, a well-known economist and gold advocate, has been a vocal critic of Bitcoin for years. His skepticism towards the digital currency is rooted in his belief that it lacks intrinsic value and is subject to extreme price volatility. Schiff’s perspective on Bitcoin has remained consistent, but what makes his criticism relevant now?

The Enduring Argument Against Bitcoin

Schiff’s primary argument against Bitcoin is that it is not a store of value like gold. In his view, gold has intrinsic value due to its scarcity and utility, whereas Bitcoin’s value is derived from market speculation and hype. He often points to Bitcoin’s volatility, which he believes makes it an unreliable store of value and a poor hedge against inflation.

Bitcoin’s Volatility: A Cause for Concern

One of the most significant concerns Schiff raises about Bitcoin is its price volatility. The digital currency’s value can fluctuate wildly within a short period, making it a risky investment. For instance, in 2017, Bitcoin’s price skyrocketed from around $1,000 to nearly $20,000 before crashing back down to around $3,000 in 2018. Such extreme price swings can make it challenging for investors to make informed decisions and can lead to significant financial losses.

The Role of Regulation

Another concern Schiff has expressed is the potential for increased regulation of Bitcoin. He argues that as more governments and financial institutions take notice of the digital currency, they may enact regulations that could limit its use or even ban it outright. Such actions could negatively impact Bitcoin’s value and make it a less attractive investment.

Impact on Individuals: Uncertainty and Risk

For individuals, Schiff’s criticism of Bitcoin means that investing in the digital currency comes with a high degree of uncertainty and risk. Those who are considering investing in Bitcoin should be prepared for the possibility of significant price volatility and potential regulatory action. It is essential to do thorough research and consider seeking advice from financial professionals before making any investment decisions.

Impact on the World: Disruption and Innovation

On a larger scale, Schiff’s criticism of Bitcoin raises questions about the digital currency’s role in the global economy. Some argue that Bitcoin’s decentralized nature and potential for disintermediation could disrupt traditional financial institutions and lead to increased financial inclusion. Others, however, see it as a speculative bubble that could burst, leading to significant financial losses and instability.

Conclusion: A Continued Debate

Peter Schiff’s criticism of Bitcoin is not new, but his perspectives remain relevant as the digital currency continues to gain popularity and attention. While his concerns about volatility, lack of intrinsic value, and potential regulation are valid, they do not detract from the broader debate about Bitcoin’s role in the global economy. As the digital currency continues to evolve, it will be essential to stay informed and consider multiple perspectives before making any investment decisions.

- Peter Schiff has been a vocal critic of Bitcoin for years

- His primary concerns are Bitcoin’s lack of intrinsic value and extreme price volatility

- Schiff believes increased regulation could negatively impact Bitcoin’s value

- Individuals should be prepared for uncertainty and risk when investing in Bitcoin

- The debate about Bitcoin’s role in the global economy continues