Ultra Clean Holdings (UCTT) Surpasses Earnings Estimates: A Detailed Analysis

In the latest quarterly financial report, Ultra Clean Holdings (UCTT) announced earnings of $0.51 per share, surpassing the Zacks Consensus Estimate of $0.44 per share. This significant beat comes as a welcome sign for investors, especially when compared to the earnings of $0.19 per share reported in the same quarter last year.

Company Overview:

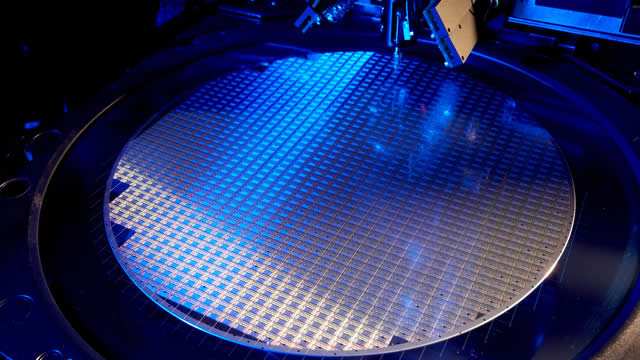

Ultra Clean Holdings, Inc. is a leading provider of advanced technologies and services used in the manufacture of semiconductors and other microtechnology products. The company operates through two business segments: Ultra Clean Technology Systems, Inc. and Ultra Clean Production Solutions, Inc. Its services include design, engineering, manufacturing, installation, and service and support for process equipment and systems used in the manufacturing of semiconductors and other microtechnology products.

Financial Performance:

The Q3 2021 earnings beat can be attributed to several factors. Firstly, the company’s revenue increased by 31.2% year-over-year to $155.3 million. This growth is primarily driven by the Semiconductor Equipment segment, which saw a 33.9% increase in revenue. Additionally, gross profit margin expanded by 2.9 percentage points to 35.6%. Operating income grew by 58.5% to $16.5 million.

Impact on Individual Investors:

For individual investors, UCTT’s strong earnings report indicates a healthy financial position for the company. The beat on earnings estimates suggests that the company is outperforming expectations, which can lead to an increase in the stock price. Furthermore, the company’s growth in revenue and expanding gross profit margin demonstrate a strong business model and positive financial trends.

Impact on the World:

On a larger scale, UCTT’s earnings beat can have a positive impact on the semiconductor industry as a whole. The semiconductor industry plays a crucial role in powering the technology that drives our modern world, from smartphones and computers to automobiles and industrial equipment. UCTT’s strong financial performance is a sign of a healthy semiconductor market, which can lead to continued innovation and growth in the technology sector.

Future Outlook:

Looking ahead, UCTT’s strong financial performance in Q3 2021 suggests a positive outlook for the company’s future. The semiconductor industry is expected to continue growing, driven by the increasing demand for technology and the ongoing shift towards automation and digitization. UCTT’s position as a leading provider of advanced technologies and services in this industry makes it an attractive investment opportunity for those looking to capitalize on this trend.

- Ultra Clean Holdings (UCTT) reported earnings of $0.51 per share, surpassing the Zacks Consensus Estimate of $0.44 per share.

- Revenue increased by 31.2% year-over-year to $155.3 million.

- Gross profit margin expanded by 2.9 percentage points to 35.6%.

- Operating income grew by 58.5% to $16.5 million.

- The strong financial performance is indicative of a healthy semiconductor market, which can lead to continued innovation and growth in the technology sector.

Conclusion:

In conclusion, Ultra Clean Holdings (UCTT) reported a strong Q3 2021 earnings beat, with earnings of $0.51 per share surpassing the Zacks Consensus Estimate of $0.44 per share. This beat is a positive sign for investors, indicating a healthy financial position for the company. Furthermore, the growth in revenue and expanding gross profit margin demonstrate a strong business model and positive financial trends. On a larger scale, UCTT’s strong financial performance can have a positive impact on the semiconductor industry and the technology sector as a whole. With a positive outlook for the semiconductor market, UCTT is an attractive investment opportunity for those looking to capitalize on this trend.