Nvidia’s Flat Performance: A Pause Before the Next Leap in Artificial Intelligence

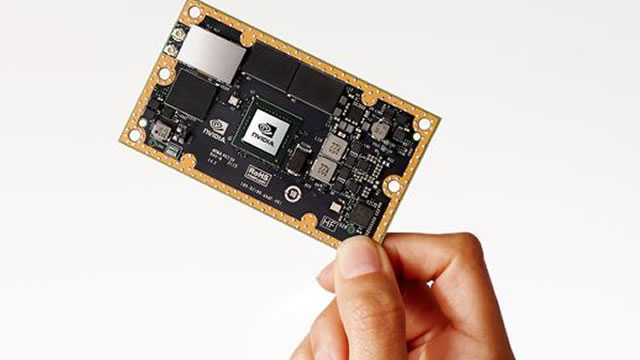

After an exhilarating two-year ride that saw Nvidia’s (NVDA) shares surge by an impressive 548%, investors have been taking a breather since November. The tech giant, renowned for its graphics processing units (GPUs) and system-on-chip units (SoCs), has been a key player in the rapidly evolving artificial intelligence (AI) industry.

The AI Industry: A New Frontier

AI is a burgeoning industry that is transforming various sectors, from healthcare and finance to gaming and self-driving cars. Companies like Nvidia are at the forefront of this revolution, providing the hardware that powers AI applications. GPUs, in particular, have become indispensable due to their ability to perform complex mathematical calculations quickly and efficiently.

Nvidia’s Growth Prospects in AI

Nvidia’s growth prospects in AI are vast, with the market expected to reach $309.6 billion by 2026, according to a report by Grand View Research. Nvidia’s GPUs are used in deep learning training, a subset of AI, which requires massive amounts of computational power. With the increasing demand for AI applications, Nvidia’s future looks promising.

Digesting Growth Prospects

However, the recent flat performance of Nvidia’s shares may be a sign that investors are taking a pause to digest the company’s growth prospects. The AI industry is rapidly changing, with new players entering the market and existing ones making significant strides. Nvidia’s competitors, such as AMD and Intel, are also investing heavily in AI and are gaining ground.

Impact on Individual Investors

- Hold: If you’re an investor who believes in Nvidia’s long-term growth prospects in AI, it might be a good idea to hold onto your shares. The recent flat performance could be a temporary setback.

- Buy: If you’re a new investor, this could be an opportunity to buy Nvidia’s shares at a lower price.

- Sell: If you’re risk-averse, you might consider selling your shares and waiting for a clearer picture of the market.

Impact on the World

- Economic Growth: The growth of the AI industry is expected to contribute significantly to economic growth, with the potential to create new jobs and industries.

- Ethical Concerns: The rapid advancement of AI raises ethical concerns, particularly around privacy and job displacement.

- Global Competition: The global race to lead in AI is intensifying, with countries like China and the US investing heavily in research and development.

Conclusion

Nvidia’s recent flat performance in the stock market could be a sign of investors taking a pause to digest the company’s growth prospects in the rapidly changing AI industry. While the industry’s future looks promising, with significant economic growth potential, there are also challenges and ethical concerns that need to be addressed. As an individual investor, it’s important to consider your risk tolerance and long-term investment goals before making any decisions. And for the rest of us, the impact of AI on the world is a fascinating and complex issue that will continue to shape our lives in profound ways.

Stay tuned for more insights on the latest trends and developments in technology and finance.