Marathon Petroleum’s Fourth-Quarter Earnings: A Closer Look

Marathon Petroleum Corp. (MPC) recently released its financial results for the fourth quarter of 2024. Let’s delve deeper into these numbers and explore what they mean for the company and its shareholders.

Financial Performance

In the fourth quarter of 2024, Marathon Petroleum reported net income attributable to MPC of $371 million, or $1.15 per diluted share. This figure represents a significant decrease compared to the same period in 2023, when the company reported net income attributable to MPC of $1.5 billion, or $3.84 per diluted share. Adjusted net income for the fourth quarter of 2024 was $249 million, or $0.77 per adjusted diluted share.

Capital Returns to Shareholders

Despite the decrease in net income, Marathon Petroleum continued its commitment to returning capital to shareholders. In 2024, the company returned a total of $10.2 billion through share repurchases and dividends.

Midstream Gulf Coast Strategy

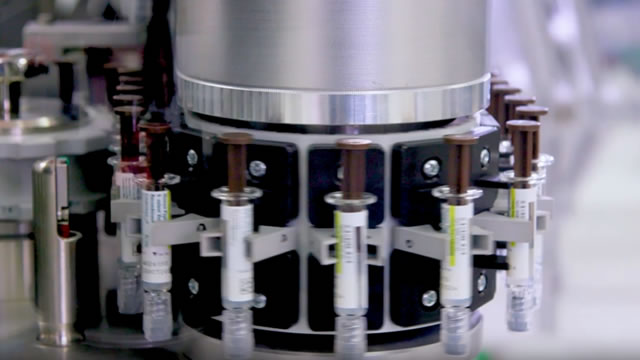

MPC’s subsidiary, MPLX, announced plans for a fractionation complex and export terminal in the Gulf Coast region. This expansion is part of the company’s Midstream Gulf Coast NGL strategy, which aims to capitalize on the growing demand for natural gas liquids (NGLs) in the region.

Impact on Shareholders

Based on the company’s projected distributions from MPLX in 2025, Marathon Petroleum shareholders can expect the distributions to cover the company’s dividends and an additional $1.25 billion in capital outlays.

Global Implications

The energy sector, and specifically the NGL market, is a global one. Marathon Petroleum’s Midstream Gulf Coast strategy is likely to have implications beyond the United States. As demand for NGLs continues to grow, particularly in Asia, companies like Marathon Petroleum that are well-positioned to capitalize on this trend may see increased profits and shareholder value.

Conclusion

Marathon Petroleum’s fourth-quarter earnings report showed a decrease in net income compared to the same period in 2023. However, the company continued its focus on returning capital to shareholders, and its Midstream Gulf Coast strategy positions it well for future success in the NGL market. For shareholders, the distributions from MPLX in 2025 are projected to cover Marathon Petroleum’s dividends and provide additional capital. On a global scale, Marathon Petroleum’s strategy is likely to have implications for the energy sector as a whole, particularly in the NGL market.

- Marathon Petroleum reported net income attributable to MPC of $371 million, or $1.15 per diluted share, for the fourth quarter of 2024.

- Adjusted net income was $249 million, or $0.77 per adjusted diluted share.

- The company returned $10.2 billion to shareholders through share repurchases and dividends in 2024.

- MPLX announced plans for a fractionation complex and export terminal in the Gulf Coast region as part of the Midstream Gulf Coast NGL strategy.

- Distributions from MPLX in 2025 are projected to cover Marathon Petroleum’s dividends and provide an additional $1.25 billion in capital outlays.

- Marathon Petroleum’s Midstream Gulf Coast strategy is likely to have implications for the global energy sector, particularly in the NGL market.