The Convergence of Major U.S. Fintechs: Block, Affirm, and PayPal

In the rapidly evolving world of finance, the lines between traditional banking institutions and technology companies continue to blur. The latest quarterly results from Block (formerly Square), Affirm, and PayPal have shed light on this trend, as these major U.S. fintechs increasingly position themselves as go-to digital banks.

Block’s Struggles and Plans

Block, the digital payments company led by Jack Dorsey, reported disappointing earnings in February 2023. The stock plummeted as much as 26% following the news. However, Dorsey remained optimistic, assuring investors that the company is executing on its plan to bring more services together for customers.

Block’s strategy includes expanding its Cash App, which now offers direct deposit, debit cards, and stock trading. The company also plans to launch a high-yield savings account and a checking account in 2023. By offering a full suite of financial services, Block aims to attract and retain customers, making it a more formidable competitor in the digital banking space.

Affirm’s Growth and Innovation

Affirm, the buy now, pay later fintech, reported impressive growth in its Q4 2022 earnings. Revenue grew 66% year-over-year, and the company’s active customers increased by 57% compared to the previous year. Affirm’s innovative approach to consumer credit has gained popularity, especially among younger demographics who prefer flexible payment options.

In addition to its core buy now, pay later product, Affirm has been expanding into new areas, such as personal loans and mortgages. By offering a range of financial products, Affirm is positioning itself as a one-stop-shop for consumers’ financial needs, further blurring the lines between traditional banks and fintechs.

PayPal’s Transformation and Global Reach

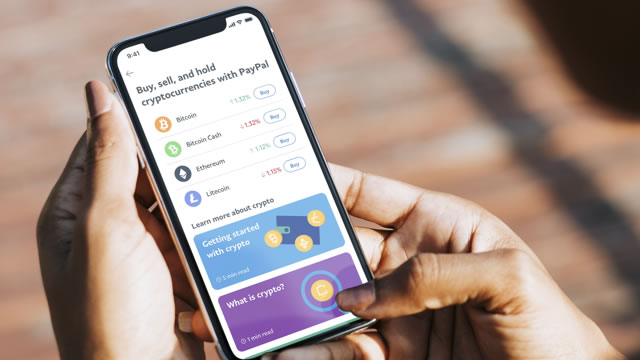

PayPal, the digital payments giant, has been transforming itself into a digital bank for several years. In 2022, the company announced plans to launch a high-yield savings account and a checking account in the U.S. These new services will allow PayPal to offer a more comprehensive suite of financial services, making it a stronger competitor in the digital banking space.

PayPal’s global reach is another advantage. With over 500 million active accounts worldwide, the company has a massive customer base. By offering financial services, PayPal can deepen its relationship with customers, providing them with more value and increasing customer loyalty.

Impact on Consumers

The convergence of these major U.S. fintechs into digital banks will have a significant impact on consumers. With a wider range of financial services offered through one platform, consumers will have more convenience and potentially better pricing and features.

- One-stop-shop for financial needs: Consumers will be able to manage their banking, investments, loans, and payments all in one place.

- Innovative products: Fintechs are known for their innovative products and services, which can lead to better experiences and more competitive pricing for consumers.

- Greater competition: The increased competition among digital banks will drive innovation and better pricing, ultimately benefiting consumers.

Impact on the World

The convergence of major U.S. fintechs into digital banks will also have a profound impact on the world. This trend will disrupt traditional banking institutions, forcing them to adapt or risk becoming obsolete.

- Increased financial inclusion: Digital banks can reach more people, especially those in underserved communities, and bring them into the formal financial system.

- Global transformation: The success of digital banks in the U.S. could lead to their rapid adoption in other parts of the world, transforming the global financial landscape.

- Economic growth: The increased competition and innovation in the digital banking space can lead to economic growth and job creation.

Conclusion

The quarterly results from Block, Affirm, and PayPal underscore the trend of major U.S. fintechs converging into digital banks. This trend will have a significant impact on both consumers and the world, with increased convenience, competition, innovation, and financial inclusion.

As these fintechs continue to expand their offerings, traditional banks will need to adapt or risk being left behind. The future of finance is digital, and these companies are leading the charge.