A Cautious Outlook for Amkor Technology: Navigating Challenges and Uncertainties

Amkor Technology (AMKR), a leading global semiconductor packaging and test services provider, has recently faced a series of challenges that have raised concerns among investors. In this blog post, we will delve deeper into these challenges and discuss their potential implications for both individual investors and the broader semiconductor industry.

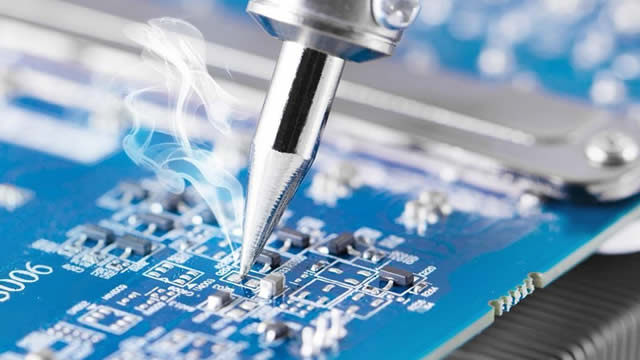

Competitive Pressure from ASE Technology and TSMC

One of the primary drivers of Amkor’s recent struggles is increased competition from industry peers, particularly ASE Technology and Taiwan Semiconductor Manufacturing Company (TSMC). These companies have been ramping up their own packaging and test services capabilities, which has put pressure on Amkor’s gross margins and utilization rates.

According to a recent report by Strategic Analysis, TSMC is expected to capture a larger share of the semiconductor packaging market, while ASE Technology is projected to grow at a faster rate than Amkor in the coming years. This competitive landscape could limit Amkor’s ability to raise prices and maintain its market position.

Ramp-Up Challenges at the Vietnam Facility

Another challenge facing Amkor is the ramp-up of its new facility in Vietnam. While the facility is expected to provide significant capacity and cost advantages, the company has faced delays and other challenges in getting the facility up and running. These issues have added to Amkor’s costs and reduced its near-term profitability.

Management’s Weak 1Q25 Guidance

Amkor’s weak 1Q25 guidance has further fueled investor concerns. The company expects revenue to decline by approximately 10% sequentially, and gross margin to drop to around 12%, the lowest level in over a decade. These numbers indicate that Amkor’s challenges are far from over.

Implications for Individual Investors

For individual investors considering Amkor Technology as an investment, it is important to consider these challenges and the potential risks they pose. With competitive pressures mounting and the company facing significant margin headwinds, it may be prudent to maintain a hold rating on AMKR stock.

Global Impact of Amkor’s Challenges

The challenges facing Amkor Technology are not limited to the company itself. The semiconductor industry as a whole could be impacted by these trends, particularly if other major players experience similar challenges. In addition, geopolitical risks, such as trade tensions between the US and China, could further complicate the landscape for semiconductor companies.

Conclusion

Amkor Technology’s recent challenges, including increased competition, ramp-up issues at its Vietnam facility, and weak 1Q25 guidance, have raised concerns among investors. These issues could limit the company’s ability to raise prices and maintain its market position, making it prudent for individual investors to maintain a hold rating on AMKR stock. Additionally, the broader semiconductor industry could be impacted by these trends, highlighting the importance of staying informed about the latest developments in this dynamic and complex market.

- Amkor Technology faces significant challenges from competitors ASE Technology and TSMC, impacting gross margins and utilization rates.

- Weak 1Q25 guidance indicates further deterioration, with revenue and gross margin expected to decline significantly.

- Competitive landscape could limit Amkor’s ability to raise prices and maintain market position.

- Ramp-up challenges at Vietnam facility have added to costs and reduced profitability.

- Geopolitical risks, such as trade tensions, could further complicate the landscape for semiconductor companies.