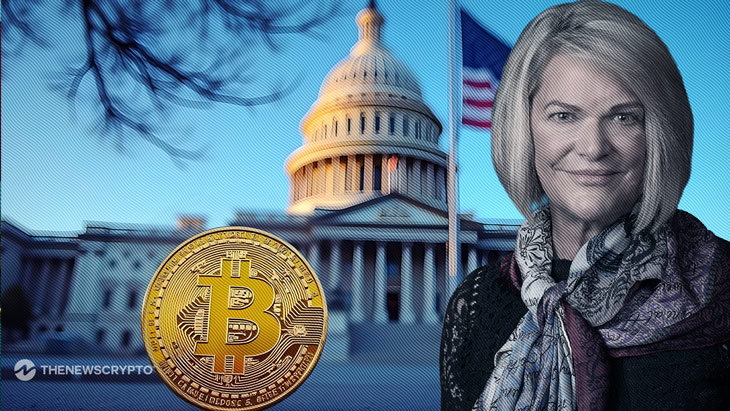

Cynthia Lummis and the Bitcoin Act: A Game-Changer in the World of Cryptocurrency

The Bitcoin Act Proposal

Last month, Cynthia Lummis, the U.S. Senator from Wyoming, made waves in the cryptocurrency world when she emphasized the importance of Bitcoin reserves’ 24/7 auditability with a basic computer. She proposed the Bitcoin Act, a groundbreaking piece of legislation that aims to establish a U.S. Bitcoin reserve. This move has sparked intense debate and speculation within the financial and tech sectors, with many experts weighing in on the potential implications of such a bold move.

The Implications of the Bitcoin Act

The proposal of the Bitcoin Act represents a major shift in how governments perceive and interact with cryptocurrencies. By creating a national Bitcoin reserve, the U.S. government would not only signal its endorsement of digital currencies but also solidify Bitcoin’s status as a legitimate asset class. This move could potentially pave the way for other countries to follow suit, leading to increased mainstream adoption of cryptocurrencies on a global scale.

Furthermore, the establishment of a U.S. Bitcoin reserve would provide a level of transparency and accountability that is sorely lacking in the current cryptocurrency market. With 24/7 auditability, investors and regulators alike would have real-time access to the U.S. government’s Bitcoin holdings, ensuring greater trust and confidence in the system.

The Impact on Individuals

For individual investors, the creation of a U.S. Bitcoin reserve could have both positive and negative consequences. On the one hand, it could lead to increased stability and legitimacy for Bitcoin, potentially driving up its value and making it a more attractive investment opportunity. On the other hand, it could also open the door to increased government oversight and regulation, potentially limiting the freedom and privacy that are hallmarks of the cryptocurrency market.

The Global Ramifications

On a global scale, the establishment of a U.S. Bitcoin reserve could have far-reaching implications for the future of finance and technology. By formalizing Bitcoin as a national asset, the U.S. government would be setting a new standard for how countries interact with cryptocurrencies, potentially reshaping the global financial landscape in the process. Other nations may be prompted to develop their own cryptocurrency reserves, leading to increased competition and innovation in the field.

Conclusion

In conclusion, Cynthia Lummis’s proposal of the Bitcoin Act represents a bold step towards mainstream acceptance and integration of cryptocurrencies into the traditional financial system. While the implications of such a move are still uncertain, one thing is clear – the world of cryptocurrency is evolving rapidly, and governments and individuals alike must be prepared to adapt to these changes.

Impact on Individuals

As an individual investor, the establishment of a U.S. Bitcoin reserve could potentially impact the value and regulation of Bitcoin. Depending on how the market reacts to this news, it could lead to increased investment opportunities or heightened government scrutiny.

Global Repercussions

On a broader scale, the creation of a U.S. Bitcoin reserve could influence how other countries approach cryptocurrencies and digital assets. This move could set a precedent for increased government involvement in the cryptocurrency market, reshaping the landscape of finance on a global scale.