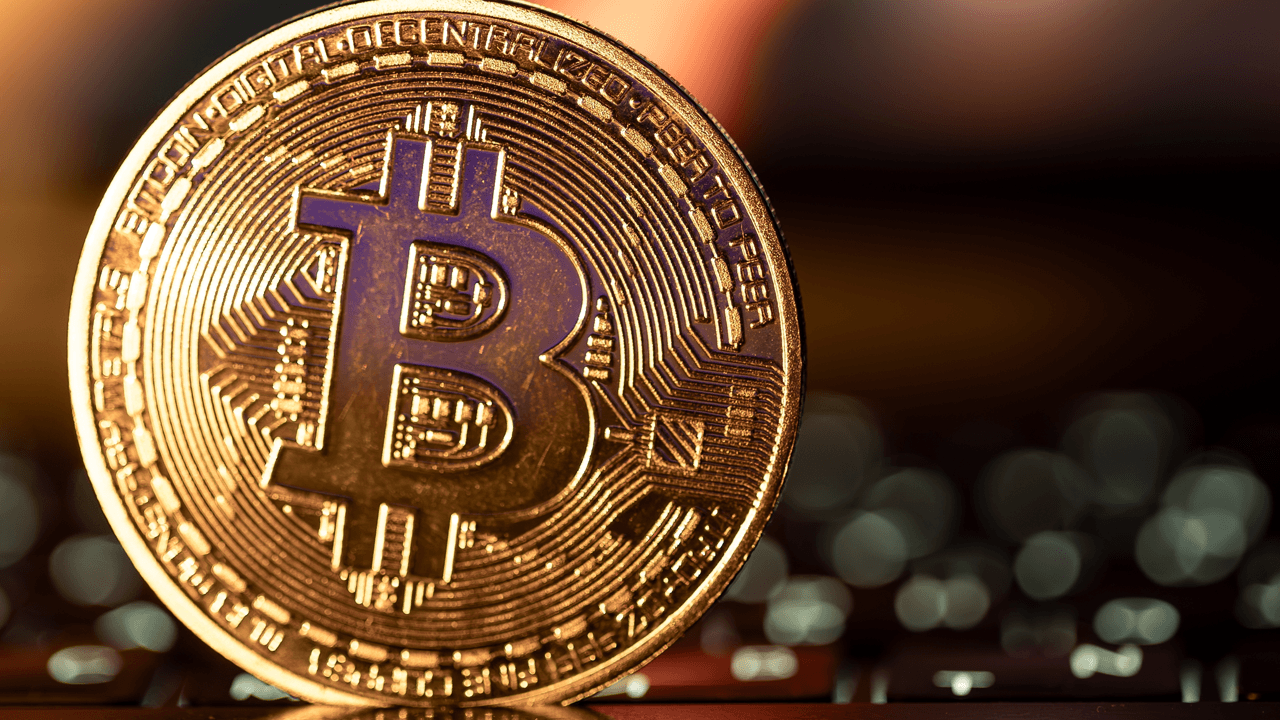

Bitcoin’s Price Stagnation: A Profound Analysis

The Current Situation

Bitcoin, the leading cryptocurrency in the market, has been struggling to break the $100,000 mark for quite some time now. Despite the efforts of cryptocurrency enthusiasts and investors, it seems that the digital currency is stuck below this crucial threshold. However, according to Derive’s Dr. Sean Dawson, there is still hope for Bitcoin to reach $125,000 by late June. In fact, Dawson’s analysis suggests that there is a 44% chance of Bitcoin hitting this milestone.

Analyzing the Factors

Several factors can be attributed to Bitcoin’s price stagnation. Market volatility, regulatory concerns, and global economic conditions all play a significant role in shaping the cryptocurrency market. Additionally, the lack of mainstream adoption and the unpredictable nature of digital assets contribute to Bitcoin’s struggles in reaching new highs.

The Impact on Investors

For investors and traders in the cryptocurrency market, Bitcoin’s price stagnation can be both frustrating and worrisome. The inability of Bitcoin to break the $100,000 mark may lead to a sense of uncertainty and doubt among investors. However, Dawson’s analysis provides a glimmer of hope and optimism for those who believe in Bitcoin’s potential to reach $125,000 by late June.

The Global Implications

Bitcoin’s price movements have far-reaching implications beyond just investors and traders. The cryptocurrency market is closely watched by regulators, financial institutions, and governments around the world. A significant price surge in Bitcoin could trigger a domino effect, leading to increased adoption of digital assets and potentially reshaping the global financial landscape.

Conclusion

In conclusion, Bitcoin’s price stagnation below $100,000 highlights the complexity and volatility of the cryptocurrency market. While the challenges are real, Dr. Sean Dawson’s analysis offers a ray of hope for those who believe in Bitcoin’s long-term potential. Whether Bitcoin will reach $125,000 by late June remains to be seen, but one thing is certain – the digital currency continues to capture the attention and imagination of investors worldwide.

Effect on Me

As an individual investor, Bitcoin’s potential price surge to $125,000 by late June could have a significant impact on my investment portfolio. If Dawson’s analysis proves to be accurate, it could lead to substantial gains and profits for me. However, I also need to be cautious and consider the risks associated with investing in volatile assets like Bitcoin.

Effect on the World

Bitcoin’s rise to $125,000 would not only benefit individual investors but also have broader implications for the global economy. Increased adoption of cryptocurrencies could challenge traditional financial systems and empower individuals to take control of their financial future. Governments and regulators may need to adapt to this changing landscape and embrace the potential of digital assets in shaping the future of finance.