The Coinbase Conundrum: A Closer Look at Q4 Results

Introduction

As cryptocurrency continues to capture the attention of investors worldwide, companies like Coinbase are experiencing both highs and lows in their financial performances. Coinbase recently reported strong Q4 results, surpassing revenue expectations and showcasing effective revenue diversification strategies. However, lingering concerns about heavy reliance on crypto cycles have left some investors cautious.

Analyzing the Numbers

In the fourth quarter of the fiscal year, Coinbase’s financials painted a rosy picture. The company managed to beat revenue expectations, a feat that is sure to impress shareholders. Revenue diversification efforts seemed to have paid off, as the company demonstrated resilience in the face of market fluctuations.

Competition Concerns

Despite the positive performance, some investors remain cautious about Coinbase’s future prospects. Competition in the cryptocurrency exchange space is fierce, and newer players are constantly emerging with innovative offerings. This poses a threat to Coinbase’s market share and could impact its long-term growth trajectory.

Valuation and Return Considerations

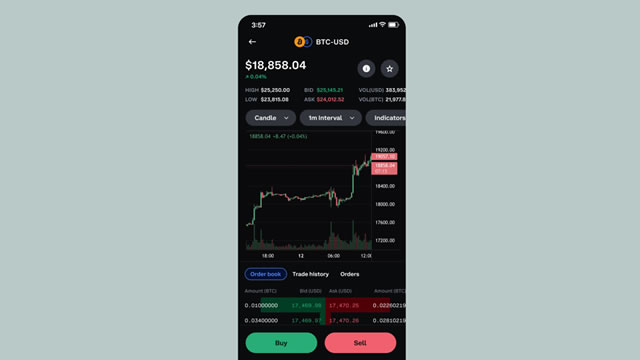

Another factor to consider is Coinbase’s current valuation. While the company may appear attractive in optimistic scenarios, the cyclical nature of the crypto market introduces a level of volatility that could impact its valuation. Investors are also keeping a close eye on historical returns from Bitcoin, which have outperformed Coinbase in recent years.

Impact on Individuals

For individual investors, the performance of Coinbase and the broader cryptocurrency market can have significant implications. Those who are invested in Coinbase or other crypto-related assets will need to closely monitor market trends and make informed decisions about their portfolios.

Global Implications

On a global scale, Coinbase’s performance can influence the broader cryptocurrency market and investor sentiment. As a key player in the industry, Coinbase’s fortunes can impact the perception of cryptocurrencies as a whole, potentially shaping future regulations and market dynamics.

Conclusion

While Coinbase’s strong Q4 results are certainly commendable, it is crucial for investors to approach the company with a balanced perspective. Competition, valuation concerns, and the unpredictable nature of the crypto market all pose challenges that must be carefully considered. As the cryptocurrency landscape continues to evolve, staying informed and making strategic investment decisions will be key to navigating the ever-changing market.