Bitcoin’s Bull Run Faces Uncertainty

Introduction

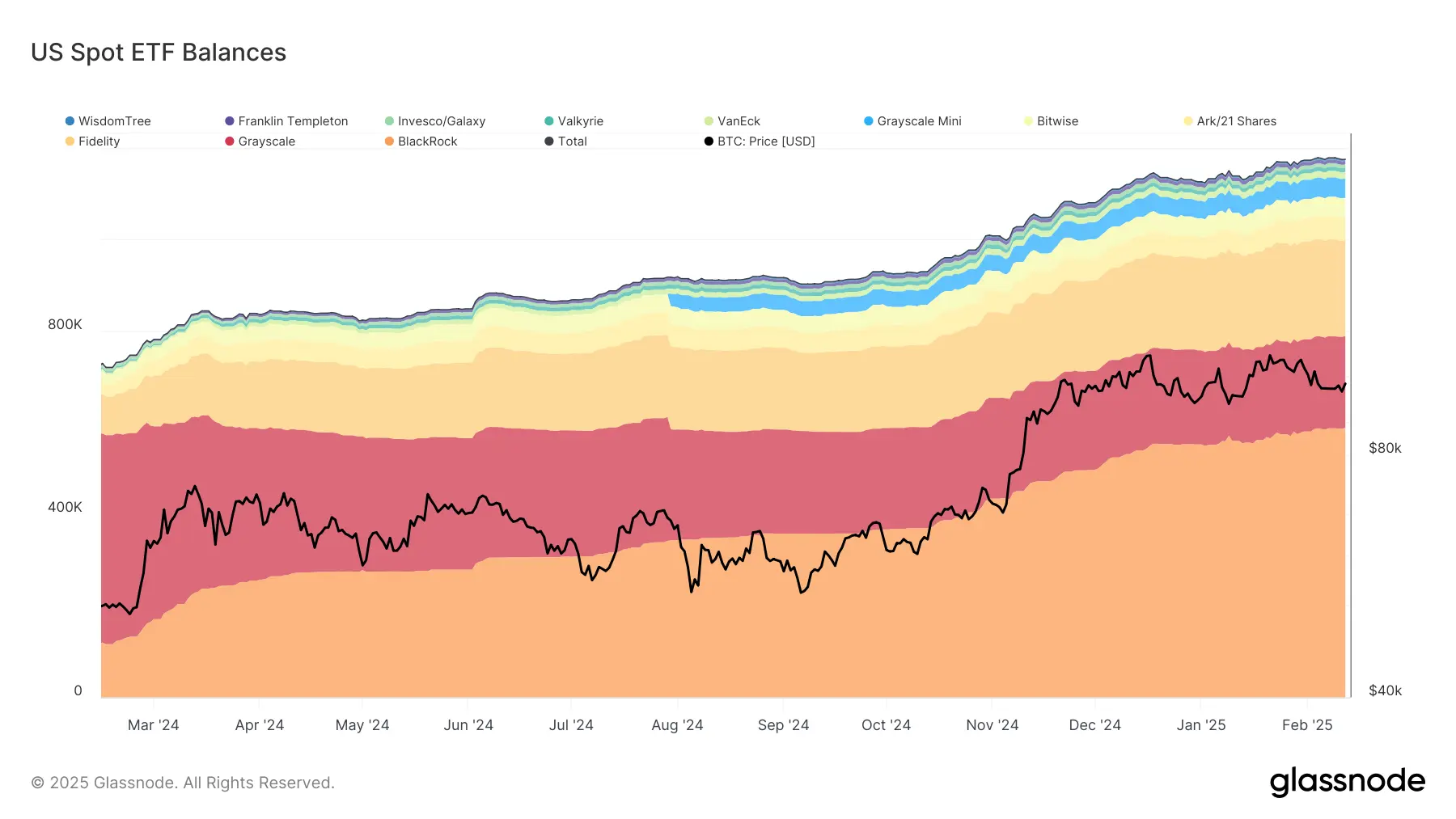

Bitcoin’s bull run, which has been gaining momentum over the past few months, now faces uncertainty as Federal Reserve Chair Powell reinforces Quantitative Tightening (QT), delaying liquidity shifts. The cryptocurrency market is closely watching as BTC dominance holds steady, but macro trends loom in the background.

The Impact of Federal Reserve Chair Powell’s Statement

Chair Powell’s recent statements regarding QT have sent shockwaves through the financial markets, including the cryptocurrency space. Quantitative Tightening refers to the Federal Reserve’s actions to reduce the size of its balance sheet by selling off assets, which could lead to higher interest rates and decreased liquidity in the markets.

Bitcoin’s Reaction

Bitcoin has traditionally been seen as a hedge against economic uncertainty and inflation, so any shifts in the macroeconomic landscape can have a significant impact on its price. The cryptocurrency market is closely monitoring how Bitcoin will react to the potential effects of QT and reduced liquidity in the markets.

The Importance of Bitcoin Dominance

Bitcoin dominance, which measures Bitcoin’s market capitalization as a percentage of the total cryptocurrency market cap, has remained relatively stable in recent months. This indicates that investors are still bullish on Bitcoin despite the uncertainty in the broader market.

How Will This Affect Me?

As an investor in Bitcoin or other cryptocurrencies, Chair Powell’s statements on QT and liquidity shifts could have a direct impact on your portfolio. It is important to closely monitor market trends and be prepared for potential volatility in the coming weeks.

How Will This Affect the World?

The Federal Reserve’s actions and statements have far-reaching effects on the global economy, including the cryptocurrency market. Any shifts in liquidity and interest rates could have ripple effects that impact financial markets around the world, so it is crucial for investors and policymakers to stay informed and adapt to changing conditions.

Conclusion

In conclusion, Bitcoin’s bull run is facing uncertainty as Federal Reserve Chair Powell reinforces QT and delays liquidity shifts. While BTC dominance remains stable for now, macro trends are looming in the background. Investors should stay vigilant and prepared for potential market volatility in the coming weeks as the cryptocurrency market adapts to changing economic conditions.