USDC and USDT Minting Accelerates, Providing Bullish Signal for Crypto Markets

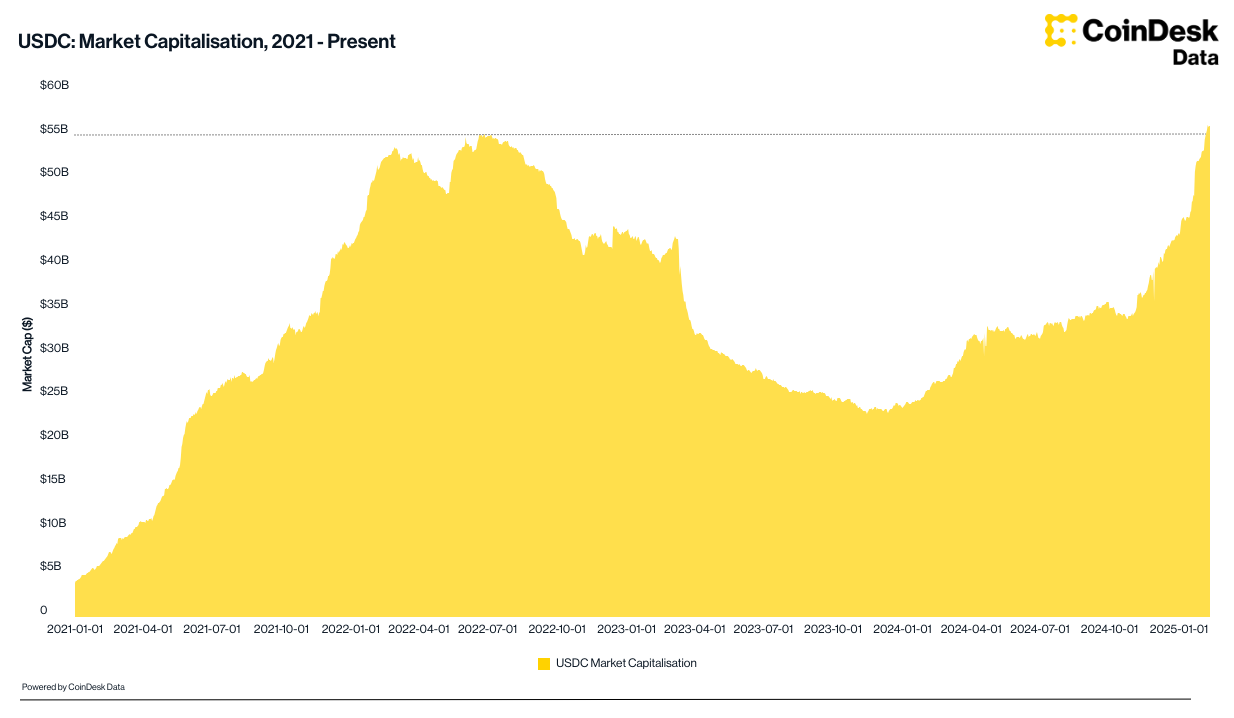

The Past Weeks Have Seen a Surge in USDC and USDT Minting

Despite declining token prices, the past weeks have shown a significant increase in the minting of USDC and USDT. This increase in stablecoin minting is a bullish signal for the crypto markets, indicating growing interest and confidence in the industry.

What Does This Surge in Minting Mean?

USDC and USDT are stablecoins that are pegged to the US dollar, providing a stable value in times of market volatility. The surge in minting of these stablecoins indicates a growing demand for a safe haven asset in the crypto space. Investors are looking for stability amid the recent market fluctuations and are turning to stablecoins to protect their investments.

This increase in minting also points to a potential influx of new capital entering the crypto markets. Investors may be looking to capitalize on the current market conditions and take advantage of buying opportunities presented by lower token prices.

Impact on Investors

For individual investors, the surge in USDC and USDT minting could provide a sense of stability in an otherwise volatile market. By holding these stablecoins, investors can protect their funds from wild price swings and have a safe asset to fall back on during uncertain times.

Additionally, the increase in stablecoin minting may indicate a growing confidence in the crypto markets, with investors seeing potential for future growth and sustainability in the industry.

Impact on the World

On a larger scale, the surge in USDC and USDT minting could have a ripple effect on the global economy. As more investors turn to stablecoins as a safe haven asset, traditional financial institutions may take notice and explore opportunities to integrate blockchain technology into their own systems.

This increased interest in stablecoins could also lead to greater adoption of digital assets in mainstream finance, paving the way for a more decentralized and inclusive financial system.

Conclusion

Overall, the recent surge in USDC and USDT minting is a positive development for the crypto markets. Despite declining token prices, the increase in stablecoin minting signals growing confidence and interest in the industry. For investors, holding USDC and USDT can provide a sense of stability in uncertain times, while on a larger scale, the trend could lead to greater adoption of digital assets in traditional finance. As the crypto markets continue to evolve, stablecoins like USDC and USDT will play an increasingly important role in shaping the future of finance.