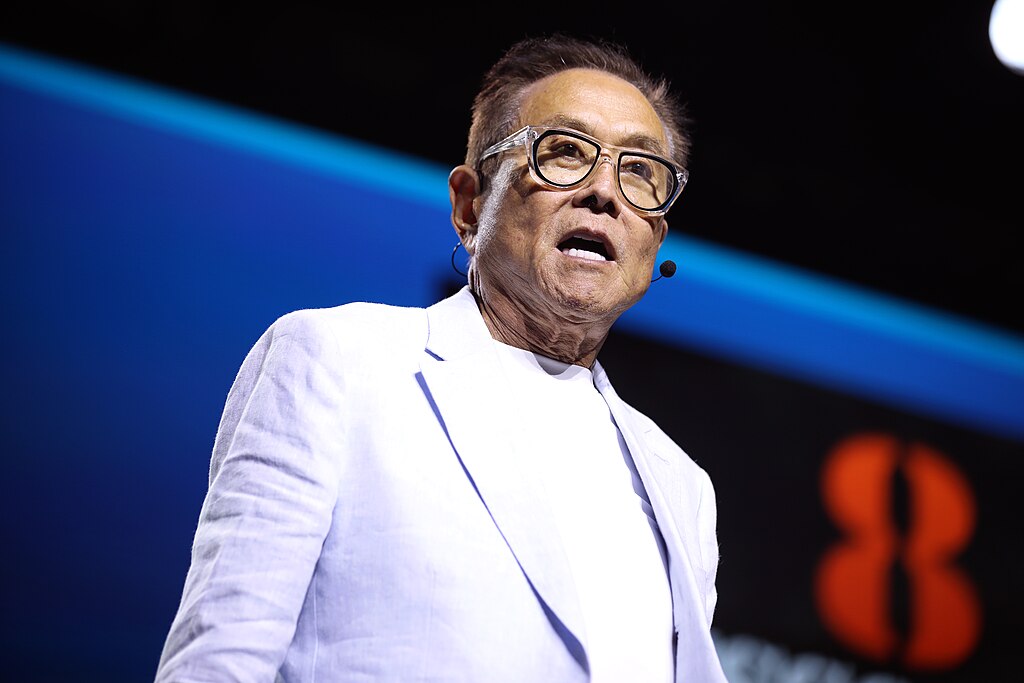

Robert Kiyosaki’s Take on Bitcoin and Gold

Renowned investor and Rich Dad Poor Dad author Robert Kiyosaki recently took to X (formerly Twitter) to discuss Bitcoin, answering a common question from his followers. He reaffirmed his belief in Bitcoin and gold as superior assets compared to fiat currencies like the U.S. dollar.

Robert Kiyosaki, known for his unconventional investment advice and financial wisdom, has once again sparked a debate among investors and financial experts with his recent comments on Bitcoin and gold. In a series of tweets on X, Kiyosaki emphasized his belief that these two assets are superior to traditional fiat currencies like the U.S. dollar.

His endorsement of Bitcoin, in particular, has caught the attention of many, given the cryptocurrency’s volatile nature and the skepticism surrounding its long-term value. Kiyosaki, however, remains steadfast in his belief that Bitcoin is a sound investment choice, citing its decentralized nature and limited supply as key factors in its appeal.

How Robert Kiyosaki’s Stance on Bitcoin and Gold Will Affect Individuals

For individual investors, Robert Kiyosaki’s endorsement of Bitcoin and gold may serve as reassurance that these assets have a place in a diversified investment portfolio. By considering alternative assets like Bitcoin and gold, individuals may be able to hedge against inflation and economic uncertainty, potentially increasing their long-term wealth.

How Robert Kiyosaki’s Stance on Bitcoin and Gold Will Affect the World

On a larger scale, Robert Kiyosaki’s advocacy for Bitcoin and gold may bring more mainstream attention to these alternative assets, prompting a shift in traditional investment strategies. As more investors and institutions consider diversifying their portfolios with Bitcoin and gold, the global financial landscape could see significant changes in the coming years.

Conclusion:

In conclusion, Robert Kiyosaki’s recent comments on Bitcoin and gold have sparked a conversation about the role of alternative assets in modern investment portfolios. Whether individuals choose to follow his advice or not, it is clear that Bitcoin and gold are becoming increasingly relevant in today’s financial markets. As the world of investing continues to evolve, it will be interesting to see how these alternative assets play a role in shaping the future of finance.