Was the Uber Technologies, Inc. post-Q4 Earnings Selloff Justified?

Overview

Many investors were caught off guard by the sharp selloff in Uber Technologies, Inc. stock following its Q4 earnings report. The company reported a slowdown in bookings growth, which raised concerns among shareholders about the health of the business. However, I believe that this reaction was overdone and that there are factors at play that could support future growth.

Factors Impacting Bookings Growth

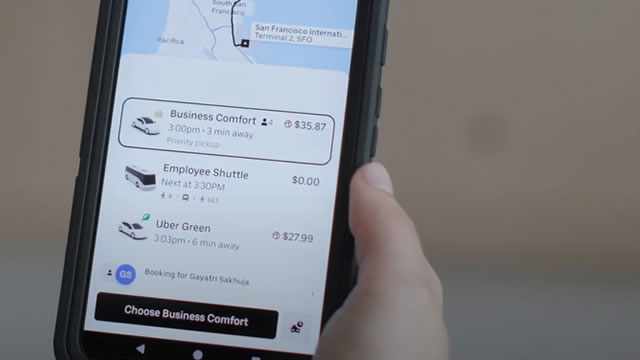

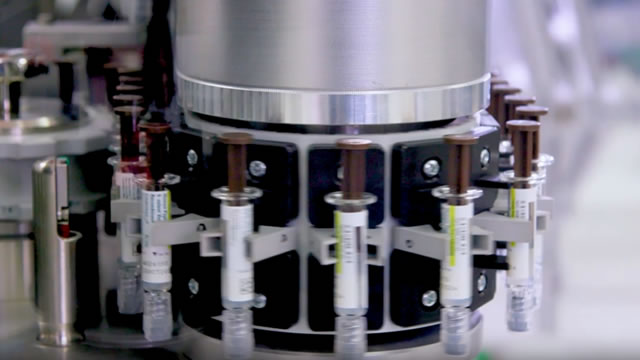

The slowdown in bookings growth was likely driven by external, one-off factors rather than a fundamental decline in Uber’s business. The company has been expanding into less dense areas, where it may take more time to establish a strong user base and see the same level of growth as in more urban areas. Additionally, Uber has been investing in the deployment of robotaxis, which could have impacted short-term bookings growth as the company tests and refines this new technology.

Future Growth Potential

Despite the current slowdown, I believe that Uber has the potential to sustain its historical double-digit bookings growth. The company’s expansion into new markets and the continued rollout of innovative services like robotaxis could drive growth in the long term. There are some regulatory risks to consider, especially concerning autonomous vehicles, but overall I remain optimistic about Uber’s growth prospects.

Price Action and Market Sentiment

From a price action perspective, Uber’s share price is currently trading close to a historical support level. This could indicate that the market is starting to find a bottom and may soon see a rebound in the stock price. Additionally, the options market sentiment is very bullish in the short term, suggesting that investors are optimistic about Uber’s performance in the coming months.

Impact on Individuals

For individual investors, the post-Q4 earnings selloff in Uber Technologies, Inc. could present a buying opportunity. With the stock trading at a potentially attractive price point and market sentiment remaining bullish, now could be a good time to consider adding Uber to your portfolio.

Impact on the World

From a broader perspective, Uber’s growth potential could have a positive impact on the world economy. As the company expands into new markets and deploys innovative technologies like robotaxis, it could create new job opportunities and drive economic growth in areas that may have been previously underserved by traditional transportation options.

Conclusion

In conclusion, I believe that the post-Q4 earnings selloff in Uber Technologies, Inc. was overdone and that there are factors at play that could support future growth. Individual investors may want to consider taking advantage of the current price levels, while the company’s expansion and technological advancements could have a positive impact on the world economy in the long term.