The impact of Analog Devices’ recent stock price movement

Overview

The latest trading day saw Analog Devices (ADI) settling at $221.45, representing a +1.04% change from its previous close. This movement in stock price reflects the dynamics of the market and the company’s performance.

Market Analysis

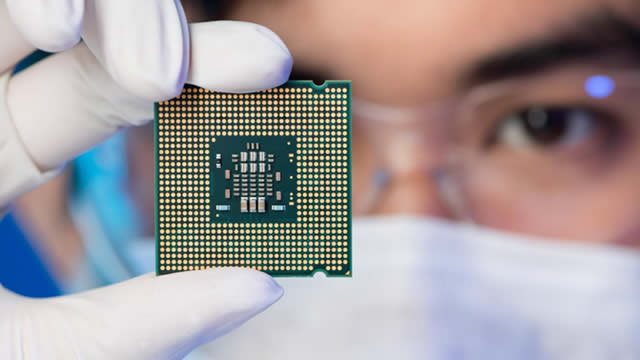

Analog Devices is a leading global technology company that designs and manufactures semiconductor products and solutions for a wide range of applications. The recent uptick in its stock price indicates positive investor sentiment and confidence in the company’s future growth prospects.

Impact on Investors

For investors holding shares of Analog Devices, the increase in stock price represents a potential increase in the value of their investment. This can lead to higher returns and improved portfolio performance.

Impact on the Industry

The technology sector is closely watched by investors and analysts, and the performance of companies like Analog Devices can have broader implications for the industry as a whole. A positive movement in stock price can signal strength and innovation within the sector.

Impact on the Economy

As a key player in the semiconductor industry, Analog Devices’ performance can also have indirect effects on the economy. A strong stock price can attract investment and support economic growth in related sectors.

How will this affect me?

As an investor, a positive movement in Analog Devices’ stock price can potentially lead to higher returns on your investment. It is important to stay informed about market trends and company performance to make informed decisions about buying or selling stock.

How will this affect the world?

In the broader context, the performance of companies like Analog Devices can impact global markets and the technology industry. A strong stock price can signal innovation and growth, which can drive advancements in technology and economic development on a global scale.

Conclusion

The recent increase in Analog Devices’ stock price reflects positive momentum in the market and the company’s performance. This movement not only affects investors and the industry but also has broader implications for the economy and the world at large. Staying informed and monitoring market trends is essential for making strategic investment decisions in this dynamic environment.