Bank of Uganda Calls for Collaboration and Innovation to Drive FinTech Growth

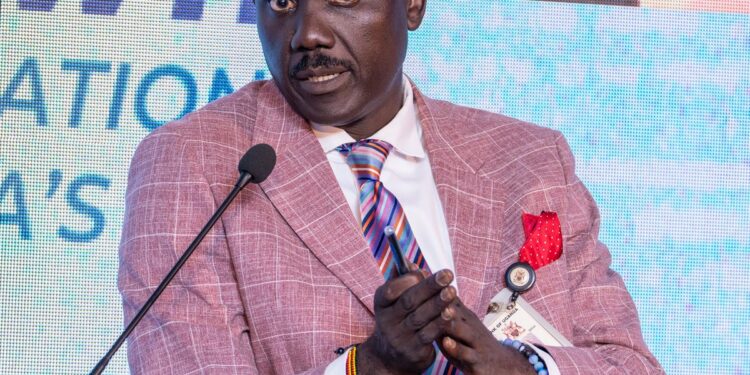

At the 6th Annual Financial Technology Service Providers Association (FITSPA) Fintech Conference, the Executive Director of National Payments Bank of Uganda officials Dr Twinemanzi Tumubweinee highlighted the need for cooperation, managing Artificial Intelligence (AI) impacts, and proactive cybersecurity measures to ensure the sustainable growth of Uganda’s digital economy. In a session focused on the future of fintech in Uganda, Dr Tumubweinee emphasized the importance of collaboration between financial institutions, fintech companies, and regulatory bodies to drive innovation and enhance financial inclusion.

Collaboration for Innovation

Dr Tumubweinee stressed the significance of partnerships and collaboration in fostering innovation within the fintech sector. By working together, stakeholders can leverage their respective strengths and expertise to develop groundbreaking solutions that meet the needs of customers and drive economic growth. He highlighted the success stories of companies that have collaborated to launch innovative products and services, emphasizing the need for a conducive environment that promotes partnerships and knowledge sharing.

Managing AI Impacts

As AI continues to transform the financial services landscape, Dr Tumubweinee underscored the need for proactive measures to manage its impacts effectively. He discussed the opportunities and challenges presented by AI in enhancing customer experiences, streamlining operations, and reducing costs. However, he also cautioned about the potential risks associated with AI, such as data privacy concerns, algorithmic biases, and job displacement. He urged industry players to adopt responsible AI practices and invest in upskilling their workforce to ensure a smooth transition to an AI-driven future.

Proactive Cybersecurity Measures

Cybersecurity emerged as a top priority during the conference, with Dr Tumubweinee highlighting the growing threat of cyberattacks in the digital age. He emphasized the importance of implementing robust cybersecurity measures to safeguard sensitive financial information and protect customers from fraud and identity theft. Dr Tumubweinee urged financial institutions and fintech companies to prioritize cybersecurity investments and adopt a proactive approach to threat detection and response.

Impact on Individuals

As the financial industry embraces collaboration, innovation, and technology, individuals can expect to benefit from a wider range of products and services that are tailored to their specific needs. The emphasis on cybersecurity and responsible AI practices will also help protect individuals’ sensitive information and ensure a secure digital banking experience.

Impact on the World

The call for collaboration and innovation in the fintech sector has the potential to drive economic growth and financial inclusion not just in Uganda, but globally. By fostering partnerships and embracing new technologies, countries around the world can unlock new opportunities for businesses and consumers, leading to a more connected and efficient global financial system.

Conclusion

In conclusion, the Bank of Uganda’s call for collaboration and innovation at the FITSPA Fintech Conference highlights the importance of working together to drive fintech growth and ensure a sustainable digital economy. By managing AI impacts and prioritizing cybersecurity measures, stakeholders can harness the power of technology to enhance financial services and promote financial inclusion. As individuals and the world at large embrace these changes, we can look forward to a more innovative and secure financial future.