The Impact of Luxury Stocks and the Boeing Strike on the Market

Introduction

In a recent episode of Barron’s Roundtable, associate editors Andrew Bary and Al Root, along with senior writer Elizabeth O’Brien, discussed various market topics, including the performance of luxury stocks and the implications of the Boeing strike. The conversation shed light on the current state of the market and provided valuable insights for investors.

Luxury Stocks Performance

The discussion on luxury stocks highlighted the resilience of high-end brands in the face of economic uncertainties. Despite market volatility, luxury companies have continued to attract affluent consumers who value quality and exclusivity. This trend indicates a strong demand for luxury goods and suggests that these stocks could be a safe haven for investors seeking stability in turbulent times.

Boeing Strike Implications

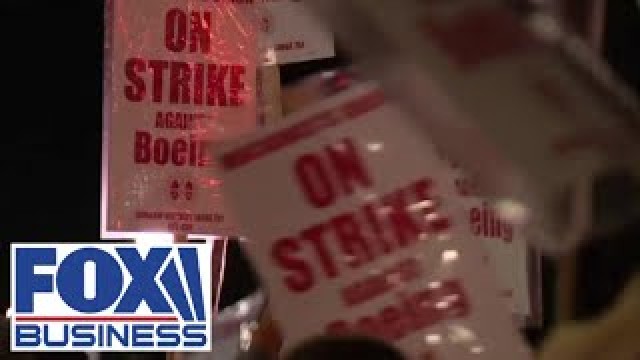

The Boeing strike has raised concerns among investors and industry experts alike. The halt in production has led to delays in aircraft deliveries and has put pressure on the aerospace giant’s financial performance. Additionally, the strike has disrupted supply chains and affected the company’s relationship with key stakeholders. These developments have the potential to impact Boeing’s stock price and overall market sentiment towards the aviation sector.

Market Impact

The insights shared on Barron’s Roundtable underscore the importance of staying informed about market trends and developments. By understanding the performance of luxury stocks and the implications of the Boeing strike, investors can make informed decisions and position themselves strategically in the market. It is crucial to monitor these factors closely and adapt investment strategies accordingly to navigate the ever-changing landscape of the financial markets.

How Will This Impact Me?

As an individual investor, the discussion on luxury stocks and the Boeing strike can have direct implications on your portfolio. By assessing the performance of luxury companies and the aerospace industry, you can make informed decisions about your investments and potentially capitalize on emerging opportunities. It is essential to stay updated on market news and trends to optimize your investment strategy and mitigate risks.

How Will This Impact the World?

The performance of luxury stocks and the Boeing strike can have broader implications for the global economy. Luxury brands play a significant role in consumer spending and economic growth, while Boeing’s operations impact the aviation industry and international trade. Any disruptions in these sectors could ripple through the global supply chain and have far-reaching consequences on various industries and markets worldwide.

Conclusion

The insights shared on Barron’s Roundtable offer valuable perspectives on the market dynamics surrounding luxury stocks and the Boeing strike. By analyzing these trends and understanding their implications, investors can navigate the ever-changing landscape of the financial markets with confidence and foresight. It is crucial to stay informed, adapt to market conditions, and make strategic investment decisions to achieve long-term success.