Clever, personable, and wonderfully unconventional, yet reader-friendly

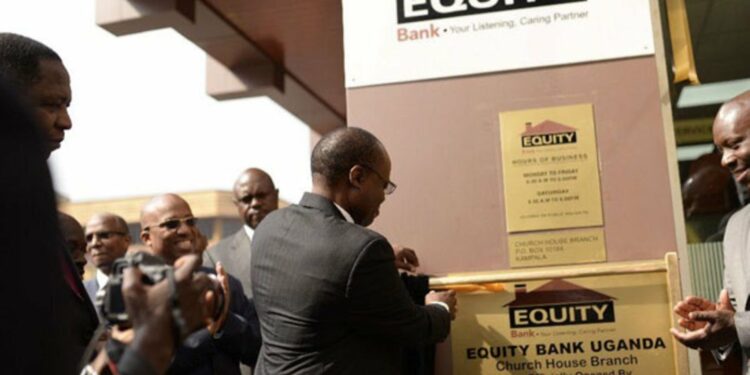

In a series of developments this week, the Uganda Police have absolved Equity Bank and Stanbic Bank of any wrongdoing in the case of a Canadian national, Clifford Max Potter, who reportedly lost over UGX 3 billion (approximately USD 1 million) in a fraudulent gold transaction between 2016 and 2019.

Background of the Case

The fraud case involving the Canadian national, Clifford Max Potter, has been making headlines in Uganda for the past few years. Allegations of a multi-billion fraudulent gold transaction have caused a stir in the financial sector, with both Equity Bank and Stanbic Bank being implicated in the case. However, in a recent turn of events, the Uganda Police have cleared both banks of any misconduct.

Clifford Max Potter, the victim in this case, reportedly lost a significant sum of money in a gold deal that spanned over three years. The transaction, which took place between 2016 and 2019, involved dubious parties who allegedly defrauded Potter of his hard-earned cash. The case has been under investigation for a while, with many speculations and accusations being thrown around.

Despite the initial suspicions surrounding Equity Bank and Stanbic Bank’s involvement in the fraudulent transaction, the Uganda Police have conducted a thorough investigation and found no evidence of wrongdoing on the part of the two financial institutions. This development has come as a relief to the banks and their customers, who were concerned about the potential repercussions of being tied to such a high-profile fraud case.

How this will affect me:

As a consumer, the absolution of Equity Bank and Stanbic Bank in the fraudulent gold transaction case provides some reassurance in the integrity of these financial institutions. It demonstrates that the authorities have conducted a thorough investigation and have found no evidence of misconduct, which bodes well for the trust and credibility of the banks.

How this will affect the world:

The outcome of this case has broader implications for the financial sector and international trade. The resolution of the fraudulent gold transaction sheds light on the importance of regulatory oversight and due diligence in preventing such crimes. It also emphasizes the need for collaboration between financial institutions and law enforcement agencies to combat financial fraud on a global scale.

Conclusion:

In conclusion, the absolution of Equity Bank and Stanbic Bank in the multi-billion fraudulent gold transaction case is a significant development that brings clarity and closure to a complex and high-profile investigation. It highlights the importance of transparency and accountability in the financial sector, and serves as a reminder of the ongoing efforts to combat financial crimes on a global scale.