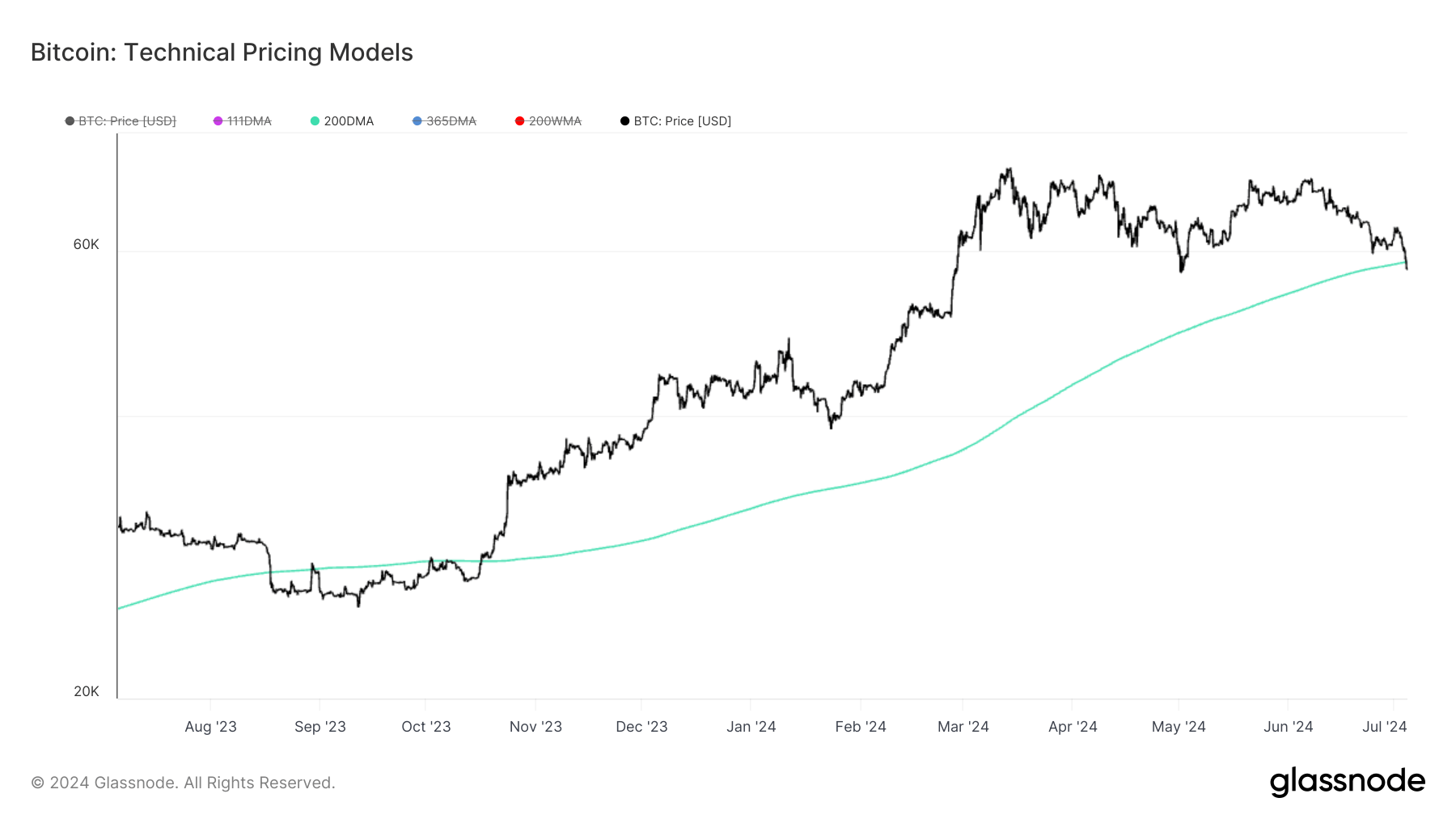

Bitcoin’s Bullish Cycle Questioned as Price Falls Below 200-Day Moving Average

Onchain Highlights

DEFINITION: The 200 Day Simple Moving Average is a common technical indicator in Technical Analysis, commonly associated with the transition point between a Bull and Bear market. Bitcoin price movements are influenced by various technical models that provide insight into market trends and potential future performance. As of July 4, Bitcoin has fallen below the 200-day moving average, sparking concerns about the cryptocurrency’s bullish cycle.

When it comes to analyzing Bitcoin’s price movements, there are a plethora of technical indicators that traders and analysts use to gain insight into market trends. One such indicator is the 200 Day Simple Moving Average (SMA), which is widely regarded as a key metric in determining the transition point between a Bull market and a Bear market.

For those unfamiliar with technical analysis, the 200-day moving average is a tool used to smooth out price data by creating a constantly updated average price over a specific time period. When Bitcoin’s price falls below this moving average, it is often seen as a bearish signal, indicating a potential shift in market sentiment.

Implications for Bitcoin’s Bullish Cycle

With Bitcoin’s price falling below the 200-day moving average, questions have arisen about the cryptocurrency’s bullish cycle. Many traders and analysts had been anticipating a strong uptrend in Bitcoin’s price, fueled by institutional adoption and widespread acceptance of cryptocurrencies. However, the recent price drop has cast doubt on these expectations, leading some to question whether Bitcoin’s bullish cycle is in jeopardy.

While it is important to note that price movements in the cryptocurrency market can be highly volatile and unpredictable, the fall below the 200-day moving average is a significant development that could have lasting effects on Bitcoin’s price trajectory in the coming months.

As investors and traders continue to monitor Bitcoin’s price movements, it will be crucial to pay close attention to how the cryptocurrency responds to this key technical indicator. Whether Bitcoin is able to bounce back and reclaim its position above the 200-day moving average will likely be a key factor in determining the future direction of its price.

How This Will Affect Me

For individual investors and traders who hold Bitcoin or are considering investing in the cryptocurrency, the fall below the 200-day moving average may be cause for concern. The bearish signal sent by this key technical indicator could indicate a shift in market sentiment and potential downward pressure on Bitcoin’s price in the short term.

If you are actively trading Bitcoin or other cryptocurrencies, it may be advisable to closely monitor price movements and consider adjusting your trading strategy in light of the recent developments. Keeping a close eye on technical indicators like the 200-day moving average can help you make more informed decisions about when to buy, sell, or hold your investments.

How This Will Affect the World

Bitcoin’s fall below the 200-day moving average could have wider implications for the cryptocurrency market as a whole. As one of the most widely traded and closely watched cryptocurrencies, Bitcoin often sets the tone for market trends and sentiment among investors and traders.

If Bitcoin’s price continues to struggle and fails to reclaim its position above the 200-day moving average, it could signal a broader shift in market dynamics and potentially dampen enthusiasm for cryptocurrencies as a whole. This could impact not only individual investors, but also institutional adoption and regulatory developments in the cryptocurrency space.

Conclusion

As Bitcoin’s price falls below the crucial 200-day moving average, the cryptocurrency’s bullish cycle is being called into question. Traders and investors are closely monitoring how Bitcoin responds to this key technical indicator, as it could signal a significant shift in market sentiment and price trajectory. Whether Bitcoin is able to rally and reclaim its position above the 200-day moving average remains to be seen, but the outcome will likely have far-reaching implications for both individual investors and the cryptocurrency market as a whole.