What to Expect from the Upcoming Oil Inventory Report

Get ready for some fluctuations in the oil market

By: Energy Enthusiast

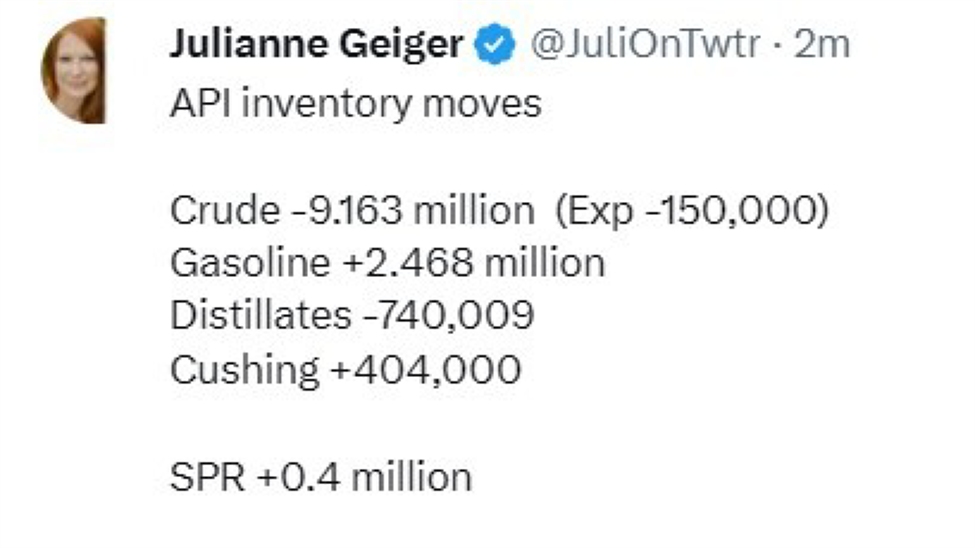

As we eagerly await the upcoming oil inventory report, the expectations are high and the stakes are even higher. The headline numbers of a decrease of 0.7 million barrels in crude oil, along with declines of 1.2 million barrels in distillates and 1.3 million barrels in gasoline, are causing a buzz in the oil industry. But what does this all mean?

The data point, collected through a privately-conducted survey by the American Petroleum Institute (API), gives us a glimpse into the current state of oil storage facilities and companies. This survey serves as a precursor to the official report that is set to be released on Wednesday morning.

It’s important to note that there are differences between the API survey and the official government data provided by the US Energy Information Administration (EIA). The EIA report is based on data from the Department of Energy and offers a more comprehensive view of the inventory levels in the US.

With the oil market constantly reacting to supply and demand dynamics, any fluctuations in inventory levels can have a significant impact on prices. Investors, traders, and industry players will be closely monitoring the upcoming report to gauge the direction of the market and adjust their strategies accordingly.

Stay tuned for the official report and be prepared for potential movements in the oil market!

How This Will Affect Me

For consumers, changes in oil inventory levels can influence the prices we pay at the pump. A decrease in inventory could potentially lead to higher gasoline prices, while an increase could result in savings for consumers. Keep an eye on the upcoming report to stay informed about possible changes in fuel costs.

How This Will Affect the World

On a global scale, fluctuations in oil inventory levels in the US can impact the overall oil market and international prices. Major oil-producing countries and oil-dependent economies will be watching the upcoming report closely to assess the potential implications on their own markets. The ripple effects of the US inventory report could be felt worldwide.

Conclusion

As we await the release of the official oil inventory report, the anticipation is building and the implications are vast. Whether you’re a consumer, investor, or industry player, the upcoming data has the potential to impact your decisions and the broader oil market. Stay informed, stay vigilant, and brace yourself for the twists and turns that lie ahead in the world of oil.