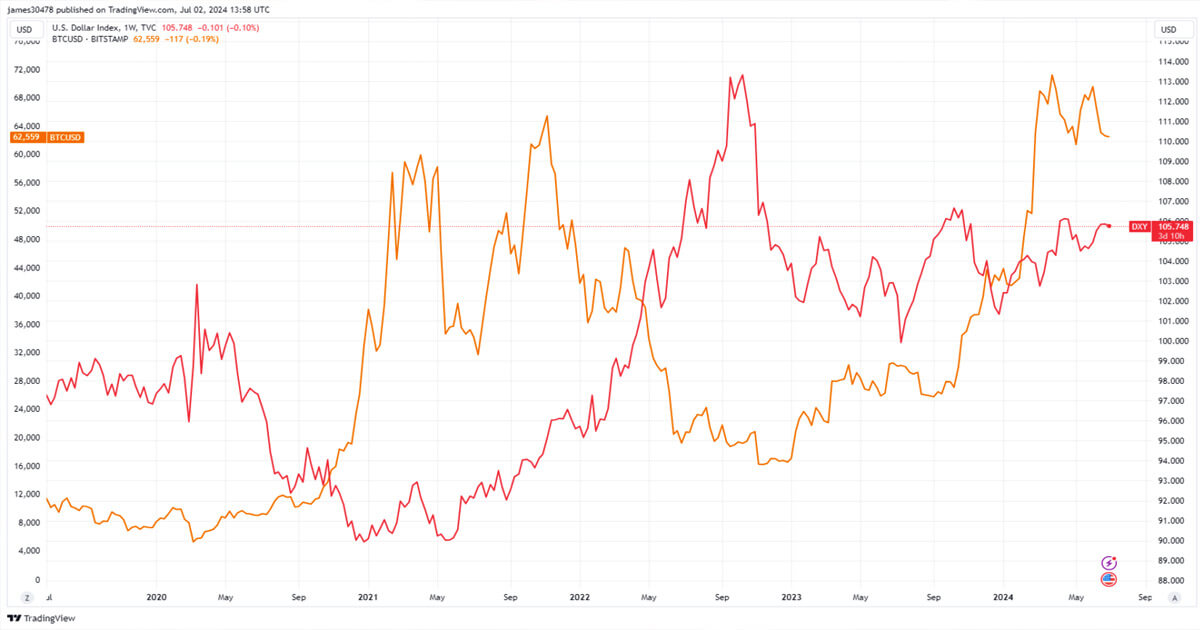

Bitcoin remains resilient amid DXY’s strength

Understanding the DXY index

The DXY index is a measure of the US dollar’s value relative to a basket of six major currencies, including the Euro, Japanese Yen, Canadian Dollar, British Pound, Swedish Krona, and Swiss Franc. The index gives insight into how the US dollar is performing compared to these other key currencies.

Weightings of currencies in the DXY index

Notably, the Euro holds the largest weighting in the DXY index at 57.6%, followed by the Japanese Yen at 13.6%, the British Pound at 11.9%, the Canadian Dollar at 9.1%, the Swedish Krona at 4.2%, and the Swiss Franc at 3.6%. These weightings indicate the influence each currency has on the overall value of the index.

Bitcoin’s resilience

Despite the strength of the DXY index and the US dollar, Bitcoin has shown resilience in the face of these currency fluctuations. While traditional assets may be affected by changes in the value of the US dollar, Bitcoin operates independently of government policies and economic indicators.

How the DXY index impacts individuals

For individuals, the DXY index can have various effects on personal finances. A stronger US dollar may lead to cheaper imports but could also make US goods more expensive for foreign buyers. This could impact the prices of goods and services, as well as travel costs for individuals.

Global repercussions

On a global scale, the strength of the DXY index can influence international trade and investments. Countries with weaker currencies may struggle to compete in the global market, while those with stronger currencies may benefit from increased purchasing power. The DXY index plays a significant role in shaping global economic trends and can have far-reaching implications for various industries.

Conclusion

In conclusion, while the DXY index reflects the US dollar’s value relative to other major currencies, Bitcoin has proven to be a resilient asset in the face of currency fluctuations. Individuals may experience the effects of a strong DXY index through changes in prices and travel costs, while the global market can be influenced by shifts in currency values. Understanding the implications of the DXY index is crucial for navigating the complex world of international finance.