The US dollar softens as New York trading ramps up

What’s behind the dollar’s pressure

As New York trading picks up this week, the US dollar is facing broad pressure in the markets. It’s unclear what is causing the dollar to weaken, as there hasn’t been any significant fundamental news driving the movement. The bond market is relatively quiet, and stocks are seeing modest gains.

The recent comments from Goolsbee, while not overly dovish, haven’t provided any support for the dollar. Fed pricing remains steady, with expectations for 47 basis points in cuts for the year.

Unexpected movements in the market

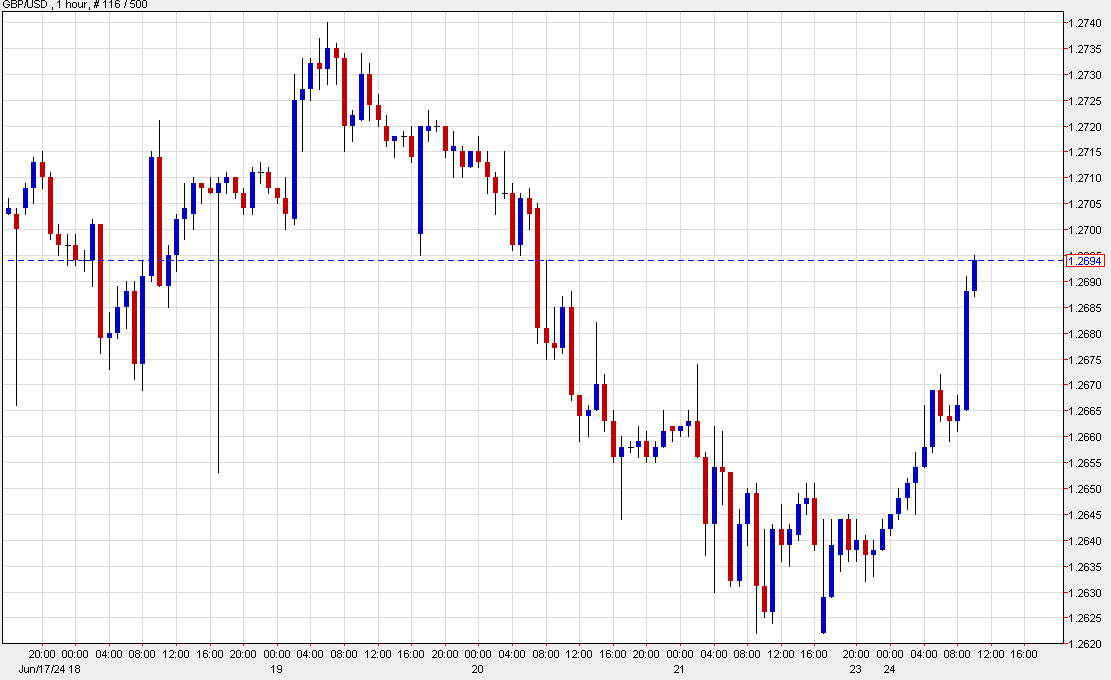

One noticeable move in the market is seen in Cable, which has risen 30 pips for no apparent reason. This unexpected movement is reflective of the general softness in the US dollar across the board.

Implications for individuals

For individuals, the weakening of the US dollar could have various effects depending on their circumstances. If you’re a US traveler planning to go abroad, a weaker dollar means your money may not go as far in foreign countries. On the flip side, if you’re an exporter, a weaker dollar could make your goods more competitive in international markets.

Global impact

On a larger scale, the softness of the US dollar has implications for the global economy. A weaker dollar can make US exports more attractive to international buyers, potentially boosting American businesses. However, it could also lead to higher import costs, impacting consumers and potentially contributing to inflation.

Conclusion

As the US dollar faces pressure in New York trading this week, the reasons behind its softness remain unclear. While individual implications may vary, the global impact of a weaker dollar could have far-reaching effects on international trade and the economy as a whole.