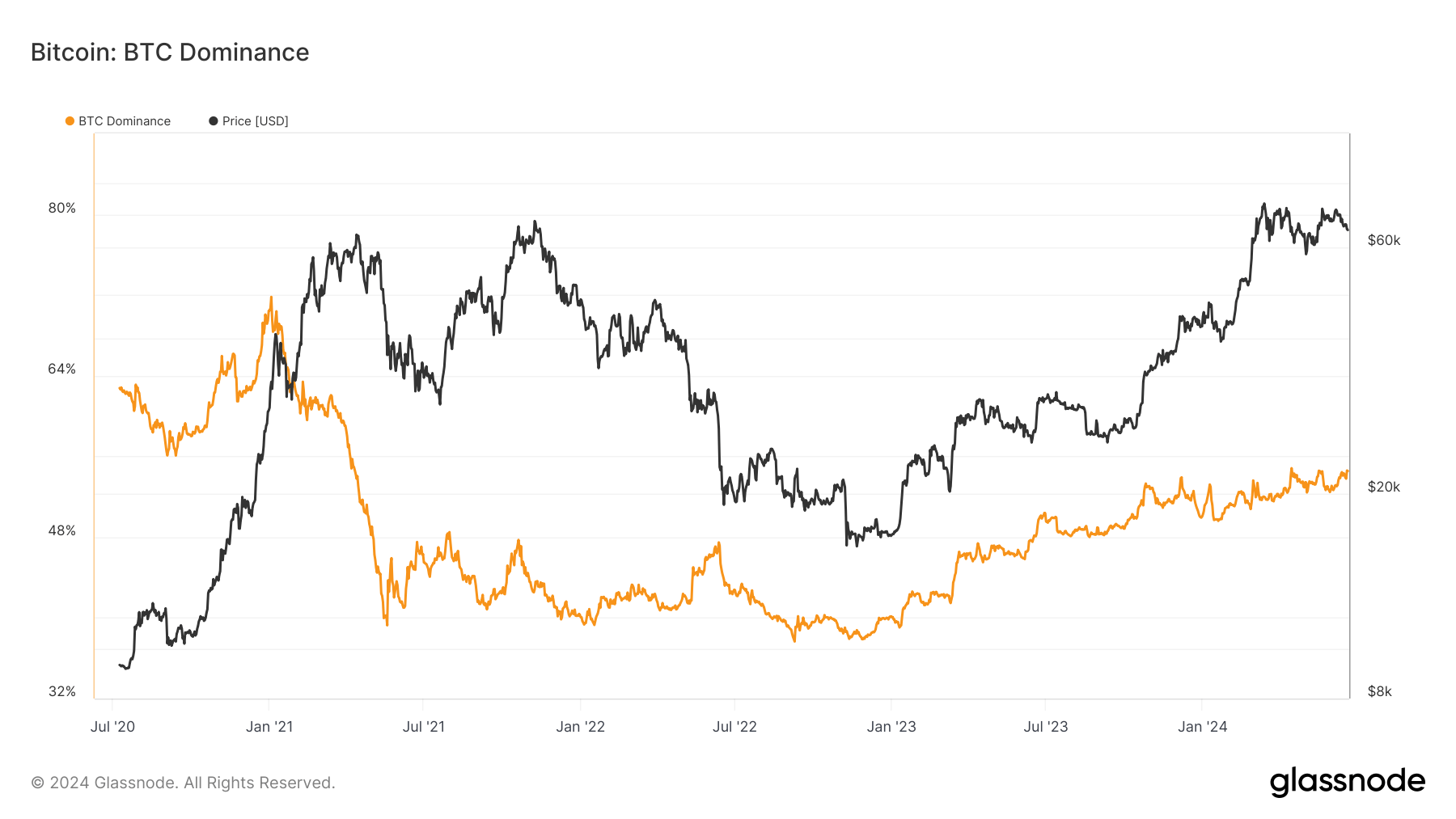

Onchain Highlights: Bitcoin Dominance Rebounds to 55% by Mid-2024

Definition of Bitcoin Dominance

Bitcoin Dominance denotes Bitcoin’s market capitalization as a percentage of the total market cap of all cryptocurrencies. It’s calculated by dividing Bitcoin’s market cap by the total cryptocurrency market cap. Bitcoin’s dominance in the digital assets market has fluctuated significantly in 2024, reflecting broader market dynamics and investor sentiment shifts.

Bitcoin Dominance Trend

Throughout the first half of 2024, Bitcoin’s dominance in the cryptocurrency market experienced a notable rebound, reaching 55% by mid-year. This resurgence represented a significant increase from earlier in the year, when Bitcoin’s dominance had dipped below the 50% mark. The uptick in Bitcoin dominance can be attributed to several factors, including renewed investor interest in the leading cryptocurrency and a stabilizing market environment.

Despite facing increased competition from a diverse range of altcoins and new blockchain projects, Bitcoin has managed to maintain its position as the dominant force in the cryptocurrency space. This renewed dominance has reinforced Bitcoin’s status as a safe haven asset and a reliable store of value in times of market uncertainty.

Impact on Individuals

For individual investors, the rebound in Bitcoin dominance carries both opportunities and risks. As Bitcoin continues to assert its dominance in the market, investors may find increased stability and security in allocating a portion of their portfolio to the leading cryptocurrency. However, heightened dominance also poses the risk of reduced diversification, as investors may overlook promising altcoins and emerging projects in favor of Bitcoin.

Impact on the World

On a broader scale, the resurgence of Bitcoin dominance signals a reassertion of the cryptocurrency’s influence on the global financial landscape. As Bitcoin’s market share grows, its impact on traditional financial systems and institutions is likely to amplify, potentially leading to greater regulatory scrutiny and market volatility. Additionally, the rising dominance of Bitcoin may influence the development and adoption of blockchain technology worldwide, shaping the future of digital finance and decentralized systems.

Conclusion

In conclusion, the rebound in Bitcoin dominance to 55% by mid-2024 reflects the resilience and enduring relevance of the leading cryptocurrency in a rapidly evolving market. As Bitcoin strengthens its position as the dominant player in the cryptocurrency space, both individual investors and the world at large are poised to experience significant implications and opportunities in the coming months and years.