The Federal Reserve’s FOMC Meeting Analysis

What to Expect from the FOMC Meeting

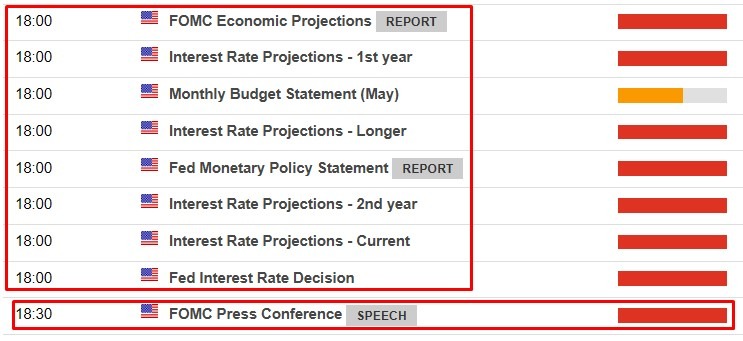

This week, the Federal Reserve’s Federal Open Market Committee (FOMC) is set to hold a crucial meeting on Tuesday and Wednesday. The highly-anticipated statement is due to be released at 2pm US Eastern time, with Fed Chair Jerome Powell scheduled to hold a press conference shortly after.

Despite much speculation and uncertainty in the market, the consensus among analysts is that there will be no rate cut this time around. However, all eyes will be on the dot plot, which is expected to show a shift from three rate cuts in 2024 to only two. This change comes after the previous update in March.

One notable prediction from Goldman Sachs is that there will be two rate cuts in September and December of 2024. Looking ahead to 2025, the investment bank expects a total of four additional rate cuts to be implemented.

Impact on Individuals

As an individual investor or consumer, the outcome of the FOMC meeting can have significant implications for your financial decisions. While a decision to keep interest rates unchanged may signal stability in the economy, any unexpected changes could lead to fluctuations in the stock market and borrowing costs.

If the dot plot reveals a more hawkish stance with fewer projected rate cuts, it may lead to a boost in bond yields and mortgage rates. Conversely, a dovish shift towards more rate cuts could potentially lower borrowing costs and stimulate economic growth.

Global Ramifications

The decisions made at the FOMC meeting have far-reaching consequences beyond the borders of the United States. Changes in US monetary policy can impact global financial markets, currency exchange rates, and trade flows.

A more hawkish stance by the Federal Reserve could strengthen the US dollar against other currencies, making exports more expensive for foreign buyers. On the other hand, a dovish approach with aggressive rate cuts may weaken the dollar and promote international trade and investment.

Conclusion

As we await the outcome of the FOMC meeting, it is essential to stay informed and closely monitor the developments in monetary policy. The decisions made by the Federal Reserve have the power to shape the economic landscape both domestically and internationally, influencing investment decisions and financial outcomes for individuals and businesses alike.