Central Bank Digital Currencies: The Future of International Payments

Is the End of Traditional Banking Near?

Central bank digital currencies (CBDCs) are gaining traction around the world, with many experts predicting that they will become the new norm for international payments within the next five years. According to Anatoly Aksakov, Chairman of the Russian State Duma’s Financial Markets Committee, CBDCs will revolutionize the way we exchange money on a global scale.

The Rise of CBDCs

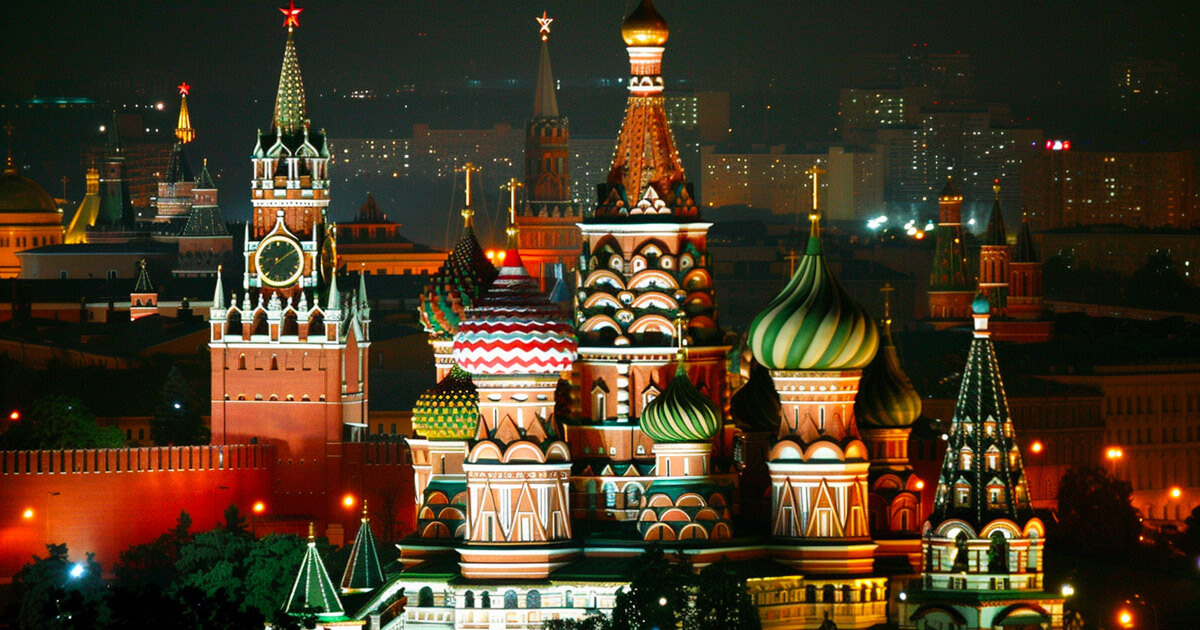

At the St. Petersburg International Economic Forum (SPIEF), Aksakov shared his insights on the future of CBDCs and their impact on the financial industry. He emphasized that countries are increasingly exploring the possibility of issuing their own digital currencies to streamline cross-border transactions and enhance financial inclusivity. With the rapid advancement of technology, CBDCs are expected to offer faster, cheaper, and more secure payment options compared to traditional banking systems.

What This Means for Me

As an individual consumer, the widespread adoption of CBDCs could simplify your financial transactions and make cross-border payments more efficient. With CBDCs, you may no longer have to rely on third-party intermediaries or incur hefty fees when sending money internationally. Additionally, CBDCs could offer greater transparency and security, reducing the risk of fraud and improving overall trust in the financial system.

The Global Impact

From a global perspective, the emergence of CBDCs could reshape the dynamics of international trade and finance. With CBDCs becoming the norm for cross-border payments, countries may no longer depend on traditional banking systems or fiat currencies for conducting business globally. This shift could lead to greater financial inclusion, reduced transaction costs, and increased economic stability on a global scale.

Conclusion

In conclusion, the rise of central bank digital currencies is set to revolutionize the way we exchange money internationally. With CBDCs expected to become widespread within the next five years, individuals and countries alike will need to adapt to this new era of digital finance. Whether you’re a consumer or a government official, the future of CBDCs holds promise for a more interconnected and efficient global economy.