14 Days of Bitcoin ETF Inflows: ARK Drops ETH ETF Amid $100M BTC Outflow

Quick Take

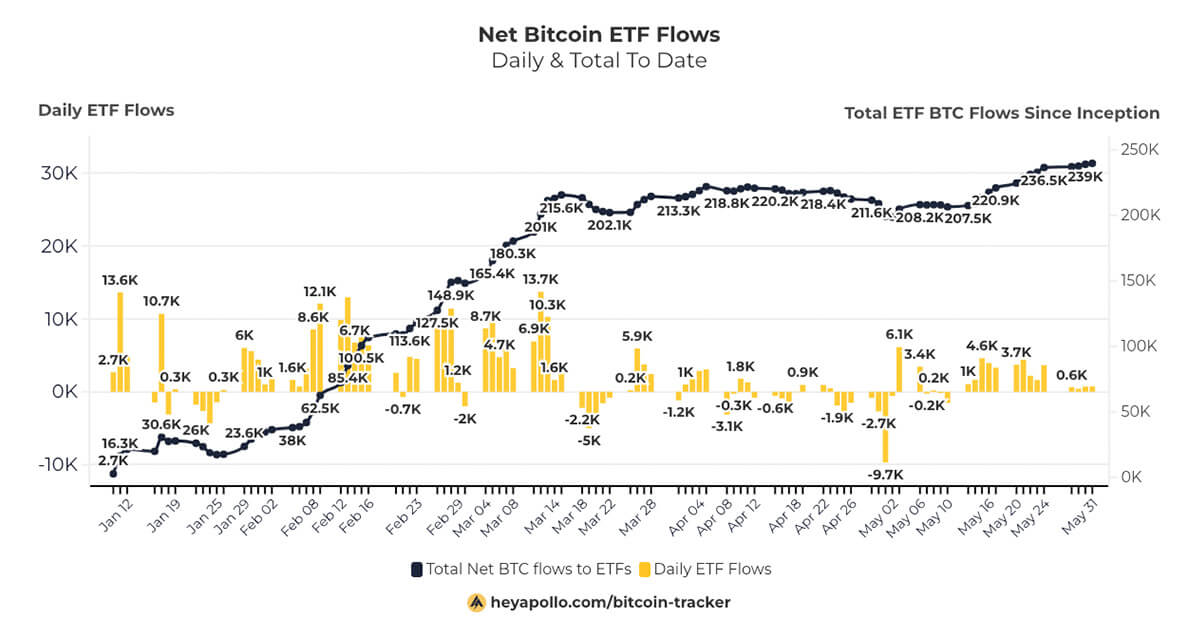

Farside data shows that on May 31, Bitcoin (BTC) exchange-traded funds (ETFs) experienced another inflow, matching the previous trading day’s amount of $48.8 million. Despite the inflows, only two issuers reported positive net inflows. BlackRock’s IBIT ETF saw the largest inflow, with $169.1 million, raising its total net inflow to $16.7 billion. Fidelity’s ETF also reported a positive net flow, albeit smaller than BlackRock’s. However, amidst the positive news for Bitcoin ETFs, ARK Investment Management made the decision to drop their Ethereum (ETH) ETF following a $100 million outflow from Bitcoin.

What Does This Mean for Me?

As an individual investor, the news of consistent inflows into Bitcoin ETFs can indicate a growing interest and confidence in the cryptocurrency market. This may lead to increased investment opportunities and potential for portfolio growth. However, the decision by ARK to drop their ETH ETF could signal a shift in focus towards Bitcoin rather than other cryptocurrencies like Ethereum. It’s important to stay informed and consider diversifying your investments to mitigate risks.

What Does This Mean for the World?

On a larger scale, the 14 straight days of inflows for Bitcoin ETFs reflect a broader trend of institutional adoption and acceptance of cryptocurrencies as legitimate assets. The significant inflows into BlackRock’s IBIT ETF demonstrate growing institutional interest in Bitcoin as a store of value and investment vehicle. Additionally, ARK’s decision to abandon their ETH ETF amid a $100 million BTC outflow could impact the overall sentiment towards Ethereum and other altcoins in the market.

Conclusion

In conclusion, the recent developments in the Bitcoin ETF landscape highlight the evolving nature of the cryptocurrency market and the shifting preferences of investors and institutions. While the consistent inflows into Bitcoin ETFs signify a positive trend for the industry, it’s essential to remain cautious and informed of the potential risks and uncertainties that come with investing in the volatile crypto market.