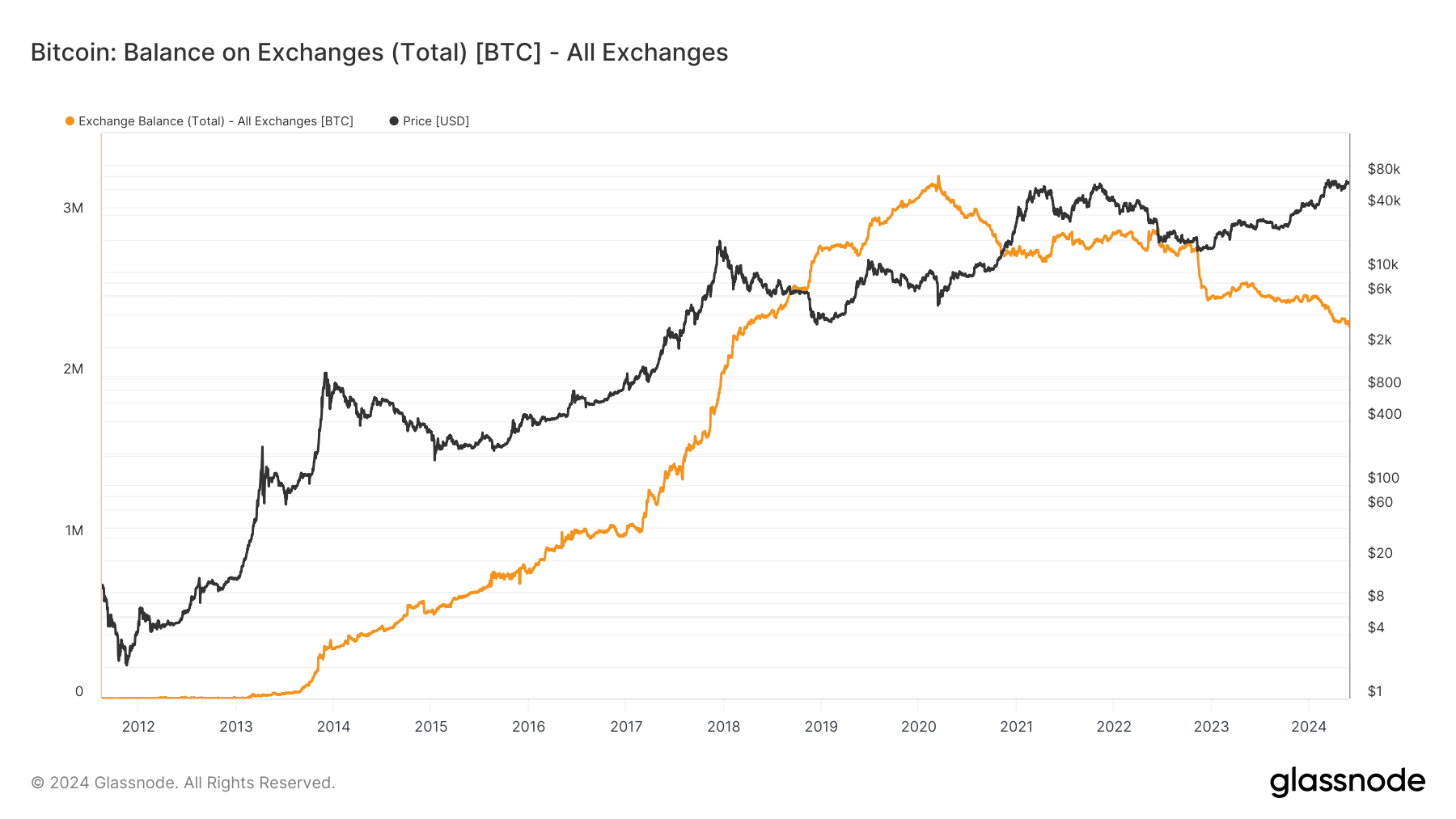

Bitcoin Exchange Balances Decline to Five-Year Low

Onchain Highlights

Balances on exchanges are the total amount of coins held on exchange addresses. Bitcoin’s balance on exchanges has continued its downward trend, reaching a significant low. As of the latest data, the total balance on exchanges has dropped below 2.3 million BTC, a level not seen since March 2018. Substantial outflows from major exchanges such as Binance and Coinbase signal long-term holding strategies.

This decline in exchange balances is a positive indicator for the cryptocurrency market as it suggests that more investors are choosing to hold onto their Bitcoin rather than trade it on exchanges. Long-term holding strategies are seen as a bullish sign for the overall market sentiment.

How This Will Affect You

If you are a cryptocurrency investor holding Bitcoin, the decline in exchange balances is a positive sign for the long-term value of your investments. By holding onto your Bitcoin instead of trading it on exchanges, you are aligning yourself with the growing trend of long-term holding strategies.

How This Will Affect the World

The decline in exchange balances and the shift towards long-term holding strategies signal a maturing of the cryptocurrency market. As more investors choose to hold onto their Bitcoin rather than trade it, the overall market becomes more stable and less susceptible to short-term price fluctuations. This increased stability can attract more institutional investors and mainstream adoption of cryptocurrencies.

Conclusion

The decline in Bitcoin exchange balances to a five-year low is a positive development for the cryptocurrency market. It signals a shift towards long-term holding strategies and increased market stability. As investors continue to hold onto their Bitcoin, the overall market sentiment becomes more bullish, paving the way for further growth and adoption of cryptocurrencies.