Rising Potential for Bitcoin as M2 Money Supply Increases

Funny Observations from Recent Data

As I was browsing through the latest data from the Federal Reserve Economic Data (FRED), I couldn’t help but notice some interesting trends. The Federal Reserve’s balance sheet has been on a bit of a rollercoaster ride, gradually declining (quantitative tightening) and currently standing at $7.3 trillion. This is down from a peak of $9.0 trillion back in April 2022. It’s like watching a game of economic limbo – how low can they go?

The M2 Money Supply and Its Significance

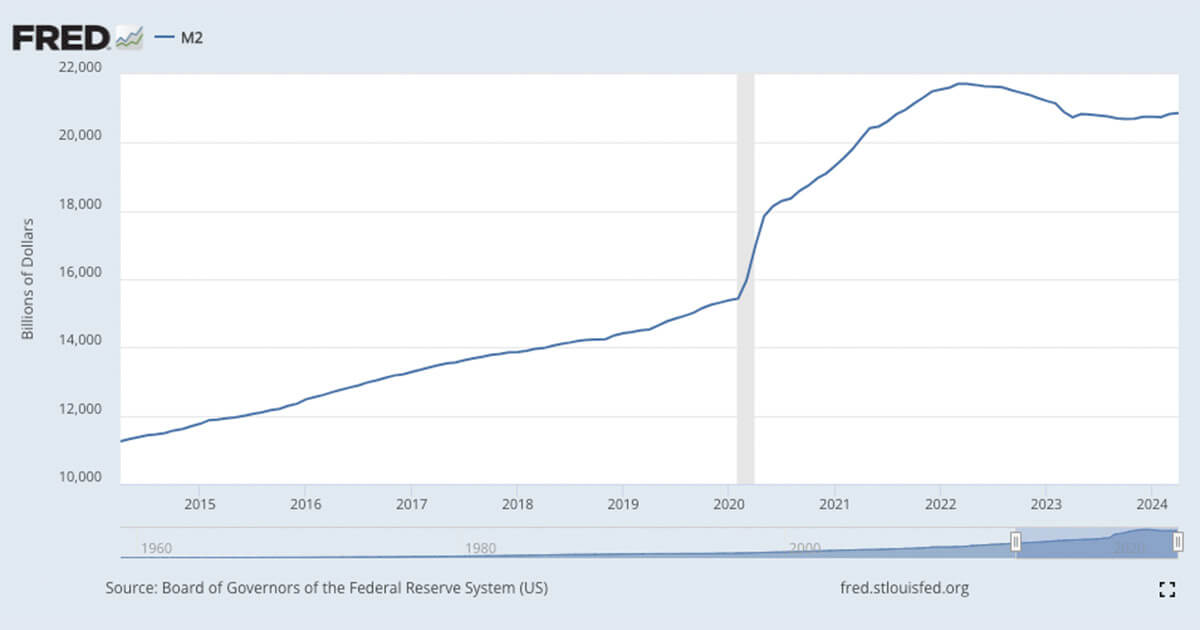

But here’s where things get really interesting – the M2 money supply is on the rise. This key indicator of the amount of money in circulation, including cash, checking deposits, and savings accounts, has been steadily increasing. This uptick in the M2 money supply could spell potential tailwinds for none other than our favorite cryptocurrency, Bitcoin.

How Does This Affect Me?

So, how does all this data actually affect us, the everyday folks just trying to make sense of the crazy world of finance? Well, for starters, an increase in the M2 money supply could lead to inflation, meaning our hard-earned money may not stretch as far as it used to. On the flip side, this could also drive more people to seek out alternative investments, such as Bitcoin, as a hedge against inflation.

How Does This Affect the World?

On a global scale, the rising M2 money supply could have far-reaching effects. Countries around the world may see an increase in economic uncertainty as central banks grapple with the implications of expanding money supplies. This could lead to shifts in global markets and currencies, as well as changes in government policies to address these new challenges.

Conclusion

In conclusion, the recent trends in the Federal Reserve’s balance sheet and the M2 money supply are certainly worth keeping an eye on. As the M2 money supply continues to rise, the potential for Bitcoin to benefit from these tailwinds becomes more apparent. Whether you’re a seasoned investor or just a curious observer, it’s always a good idea to stay informed and be prepared for whatever the financial future may hold.