Welcome to today’s market update!

The Eurozone May Flash CPI and US April PCE

Today’s Highlights:

Today, the highlights will be the Eurozone May Flash CPI and the US April PCE, which is the Fed’s preferred measure of inflation. The other notable release scheduled for today include the Swiss Manufacturing PMI and the Canadian GDP although they are unlikely to be market moving.

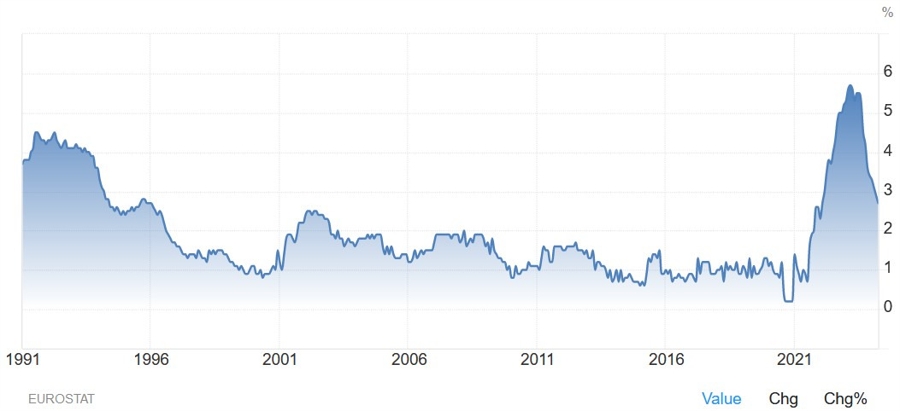

09:00 GMT – Eurozone May Flash CPI

The Eurozone Headline CPI Y/Y is expected at 2.5% vs. 2.4% prior, while the Core CPI Y/Y is seen at 2.8% vs. 2.7% prior. This report is likely to influence the market’s expectations for…

How will this affect me?

As an individual consumer, the Eurozone CPI data can provide valuable insight into the level of inflation in the region. A higher than expected CPI could signal rising prices, potentially impacting your purchasing power and cost of living.

How will this affect the world?

The Eurozone CPI data is closely watched by economists and policymakers around the world as it can have implications for global inflation trends. A significant deviation from expectations could impact international trade and monetary policy decisions.

Conclusion:

Keeping an eye on key economic indicators like the Eurozone May Flash CPI and US April PCE can help individuals and businesses make informed decisions in a rapidly changing economic environment. Stay tuned for updates on market movements and analysis!