The Resilience of the Investment Funds Industry in Cyprus

Cyprus Fund Assets Rise 4.5%, Ending Two-Quarter Slide

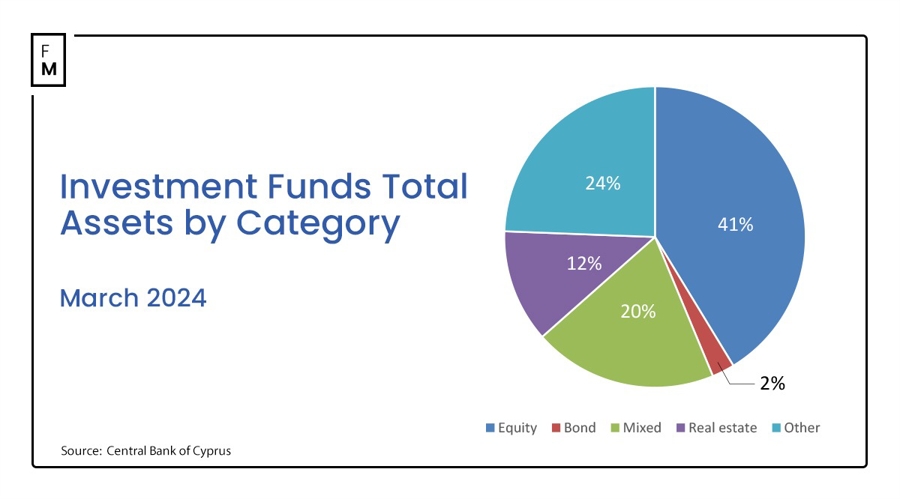

The investment funds industry in Cyprus demonstrated resilience in the first quarter of 2024, with total assets under management increasing for the first time after two consecutive quarterly declines, according to the latest statistics from the Central Bank of Cyprus.

As of March 31, 2024, the total assets of Cypriot investment funds stood at €6.79 billion, a 4.51% increase from €6.50 billion at the end of December 2023. The number of reporting funds also increased by 3.2% during the same period.

Impact on Individuals:

Individual investors in Cyprus may benefit from the growth in the investment funds industry as it provides them with more opportunities to diversify their portfolios and potentially earn higher returns. With the increase in total assets under management, there may also be a boost in investor confidence, leading to more inflows into investment funds.

Impact on the World:

The positive performance of the investment funds industry in Cyprus can have a ripple effect on the global financial markets. As Cyprus attracts more investments and gains a stronger foothold in the fund management sector, it could boost the country’s overall economic stability and contribute to the growth of the global economy.

Conclusion:

The increase in total assets under management in the Cyprus investment funds industry in the first quarter of 2024 is a promising sign of resilience and growth. This positive trajectory not only benefits individual investors in Cyprus but also has the potential to make a positive impact on the world economy. It will be interesting to see how this momentum continues in the coming quarters and how it further shapes the investment landscape in Cyprus and beyond.