The Rise of „Gen T”: Younger Investors Embrace Active Trading Strategies

A New Generation of Investors Emerges

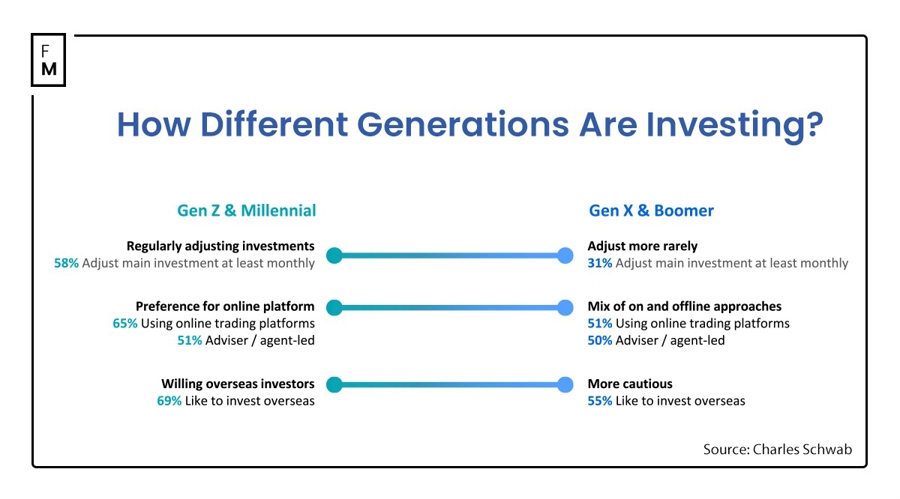

In a recent study by Charles Schwab UK, a striking generational divide has emerged among UK retail investors, revealing that Gen Z and Millennial investors are adopting more active and open investment strategies than their older counterparts. This new generation of investors, dubbed „Gen T” for their trader-like behaviors, is reshaping the investment landscape.

Changing the Game

The research highlights that younger investors are making significant waves in the investment world by embracing active trading strategies. Unlike the traditional buy-and-hold approach favored by older generations, Gen Z and Millennials are taking a more hands-on approach to managing their portfolios.

These young investors are not afraid to take risks and are more inclined to seek out new opportunities in the market. They are tech-savvy, well-informed, and eager to learn, making them a force to be reckoned with in the world of investing.

With access to a wealth of information at their fingertips, thanks to the internet and social media, Gen T investors are able to make informed decisions in real-time. They are not content to sit back and passively watch their investments grow – they want to actively participate in the market and capitalize on emerging trends.

How Gen T Will Impact You

As a individual investor, the rise of Gen T could have a direct impact on your own investment strategies. With younger investors driving more volatility and activity in the market, it is important to stay informed and be adaptable to changing trends. Keeping an eye on Gen T’s movements and preferences could help you to capitalize on new opportunities and stay ahead of the curve.

How Gen T Will Impact the World

On a larger scale, the emergence of Gen T investors is likely to shake up the traditional investment landscape. As more young people enter the market with their active trading strategies and appetite for risk, we can expect to see a shift in the way investments are made and managed. This could lead to increased competition, innovation, and disruption in the financial industry as a whole.

Conclusion

With „Gen T” investors leading the charge, the world of investing is undergoing a seismic shift. As younger investors embrace active trading strategies and reshape the market, it is more important than ever to stay informed, adaptable, and open to new opportunities. The future of investing is in the hands of Gen T – are you ready to join the ride?