Yesterday’s Market Movement: A Fundamental Overview

USD Weakens Across the Board

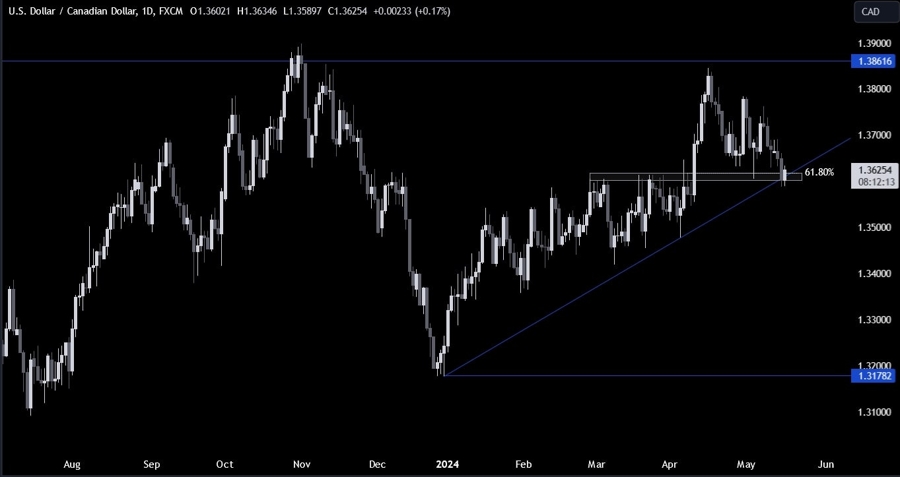

Yesterday, the USD weakened across the board following a benign US CPI report where the data came in line with expectations. The market firmed up the rate cuts expectations with September and December now fully priced in. We saw a general risk-on sentiment as a result and barring negative surprises in the following days and weeks, this trend might have some more legs.

Today’s US Jobless Claims Data

Today’s US jobless claims data don’t change the picture, on the contrary, they might reaffirm the positive sentiment in the market. With the weakening of the USD and the expectation of rate cuts, investors are looking for opportunities in other asset classes to maximize their returns.

As we move forward, it is important to keep an eye on any new developments that may impact the market sentiment and adjust our strategies accordingly. The current environment presents both risks and opportunities for investors, and staying informed is key to making wise decisions.

Impact on Individuals

For individuals, the weakening of the USD and the expectation of rate cuts may have various effects on personal finances. It could lead to lower interest rates on loans and mortgages, making it a good time to consider refinancing or taking out new loans. It could also impact the cost of imported goods, potentially leading to price fluctuations in consumer products.

Impact on the World

On a global scale, the weakening of the USD could affect international trade and investment flows. Countries that rely heavily on exports to the US may see a boost in their competitiveness, while those with high exposure to USD-denominated debts may face challenges. The shift in market sentiment could also influence the performance of global stock markets and commodities.

Conclusion

In conclusion, the recent market movements and the expectations of rate cuts have created a dynamic environment for investors to navigate. It is important to stay informed, monitor developments closely, and adapt to changing conditions to make the most of the opportunities presented. By understanding the implications of these trends on both individual financial situations and the global economy, investors can make more informed decisions to achieve their desired outcomes.