The Race to Go Public: Marex Group Files for US IPO

Introduction

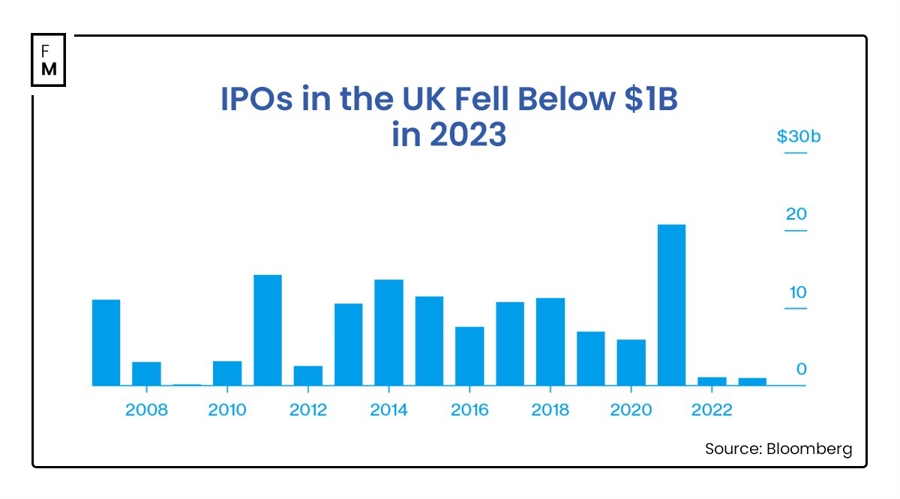

The race to go public in the United States has gained a new contender as Marex Group, a UK-based financial services platform, has thrown its hat into the ring by filing for an initial public offering (IPO) of ordinary shares with the Securities and Exchange Commission (SEC).

Marex Group Files for US IPO, Aims to List on Nasdaq

The details of the offering, including the timing, number of shares to be offered, and the price range, have not yet been determined. However, the company aims to list its shares on the Nasdaq Stock Market, joining a growing list of companies choosing this exchange for their IPOs.

Going public can provide a company with access to additional capital, increased visibility, and a currency for acquisitions. It can also create liquidity for existing shareholders and employees who hold stock options.

Impact on Me

As an individual investor, Marex Group’s IPO could offer an opportunity to invest in a growing financial services platform. It is important to carefully consider the risks and rewards associated with investing in any IPO and to conduct thorough research before making investment decisions.

Impact on the World

Global markets may see increased interest and investment activity as Marex Group goes public in the United States. This could have implications for the broader financial services industry and the economy as a whole. It will be interesting to see how Marex Group’s IPO impacts competition and innovation within the financial services sector.

Conclusion

The filing of Marex Group for a US IPO marks an exciting development in the race to go public. As the company prepares to list its shares on the Nasdaq, investors and industry observers will be watching closely to see how this move shapes the future of the financial services industry.