The Financial Conduct Authority’s New Guidance on Social Media Marketing

Fairness in Financial Promotions

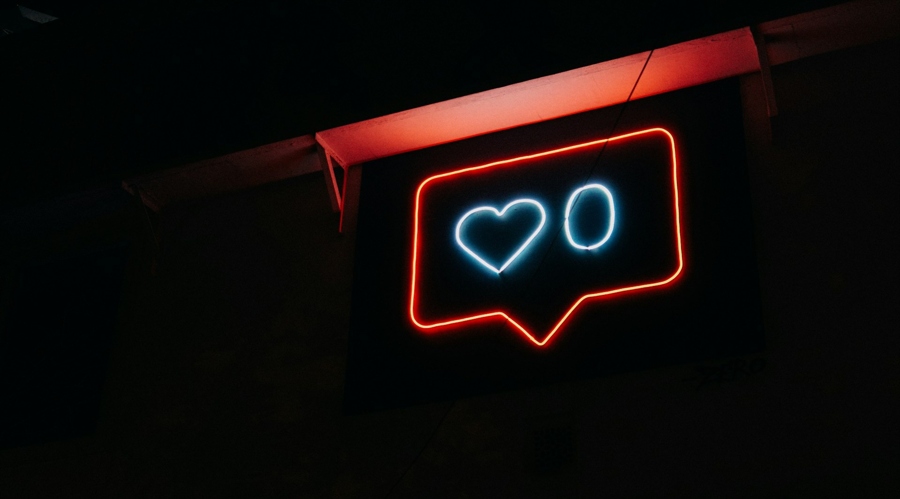

The Financial Conduct Authority (FCA) has issued new guidance to ensure that financial promotions on social media platforms are fair, clear, and not misleading. The regulator scrutinized the latest forms of network marketing, including memes, reels, and gaming streams.

This move comes as social media becomes increasingly important in firms’ marketing strategies.

FCA Cracks Down on Misleading Financial Ads on Social Media

The FCA has warned both firms and influencers that they must adhere to the rules and regulations set forth by the authority. The crackdown on misleading financial ads on social media is a step towards protecting consumers from fraudulent schemes and deceptive practices.

Many consumers rely on social media for financial advice and recommendations, making it crucial for the FCA to ensure that the information they receive is accurate and trustworthy.

Impact on Consumers

As a consumer, the FCA’s new guidance on social media marketing can help you make more informed decisions when it comes to financial products and services. By cracking down on misleading ads, the authority is working to protect your interests and ensure that you are not taken advantage of by unscrupulous marketers.

It is important to remain vigilant when scrolling through social media and to always verify the information presented in financial promotions before making any decisions.

Global Implications

The FCA’s focus on social media marketing is likely to have a ripple effect on the global financial industry. As other regulatory bodies take note of the authority’s efforts to combat misleading ads, they may also implement similar guidelines to protect consumers in their respective regions.

This coordinated approach to regulating financial promotions on social media could lead to a more transparent and trustworthy environment for consumers worldwide.

Conclusion

In conclusion, the FCA’s new guidance on social media marketing is a positive step towards ensuring fairness and transparency in financial promotions. By cracking down on misleading ads, the authority is working to protect consumers and uphold the integrity of the financial services industry. It is essential for both firms and influencers to adhere to these guidelines to maintain trust and accountability in their marketing practices.