Consumer and Producer Prices on the Rise

Recent data has shown that consumer and producer prices have risen more than expected in the US. This has led to concerns about inflationary pressures and the impact it may have on the economy. In addition, there was a smaller-than-expected increase in US retail sales, which has also raised some eyebrows among investors.

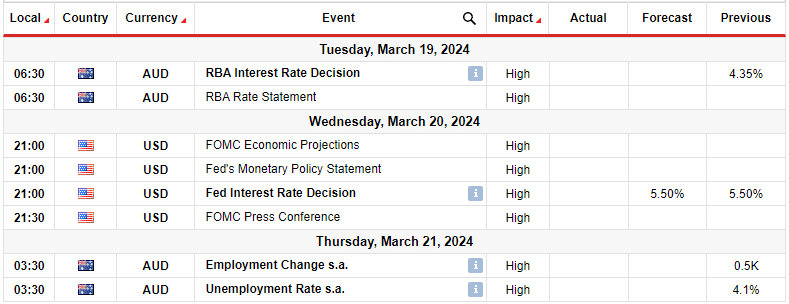

Policy Decisions in Focus

Investors are eagerly awaiting policy decisions in both the US and Australia. The Federal Reserve in the US is expected to adjust its tone amid high inflation, which could have a significant impact on global markets. Meanwhile, in Australia, policymakers are also facing tough decisions as they navigate the economic fallout from the pandemic.

The AUD/USD Weekly Forecast

The AUD/USD weekly forecast is currently bearish, as Fed policymakers may dial down their dovish tones in response to lingering inflationary pressures. This could lead to increased volatility in the currency markets, with the Australian dollar potentially facing downward pressure against the US dollar.

Ups and Downs of AUD/USD

The AUD/USD exchange rate has seen its fair share of ups and downs in recent months. The Australian dollar has been sensitive to changes in global economic conditions, particularly as investors weigh the impact of rising inflation on central bank policies. The US dollar, on the other hand, has been supported by expectations of a more hawkish stance from the Federal Reserve.

How Will This Affect Me?

As a consumer, you may start to feel the effects of rising inflation in the form of higher prices for goods and services. This could put pressure on your budget and lead to a decrease in purchasing power. Investors may also need to reassess their portfolios in light of the changing economic landscape, as central banks adjust their policies to combat inflation.

How Will This Affect the World?

The impact of rising inflation and changing central bank policies in the US and Australia will be felt around the world. Global markets are likely to experience increased volatility as investors digest the latest economic data and policy decisions. Developing countries, in particular, may face challenges as they navigate the changing tides of the global economy.

Conclusion

In conclusion, the recent data on consumer and producer prices, as well as the upcoming policy decisions in the US and Australia, are likely to have far-reaching implications for the global economy. As investors brace for increased volatility in the currency markets, consumers may need to adjust to higher prices and reduced purchasing power. It’s clear that the road ahead is uncertain, but staying informed and proactive in managing your finances will be key in navigating these challenging times.