The Federal Reserve’s Potential Shift to a More Hawkish Stance

Introduction

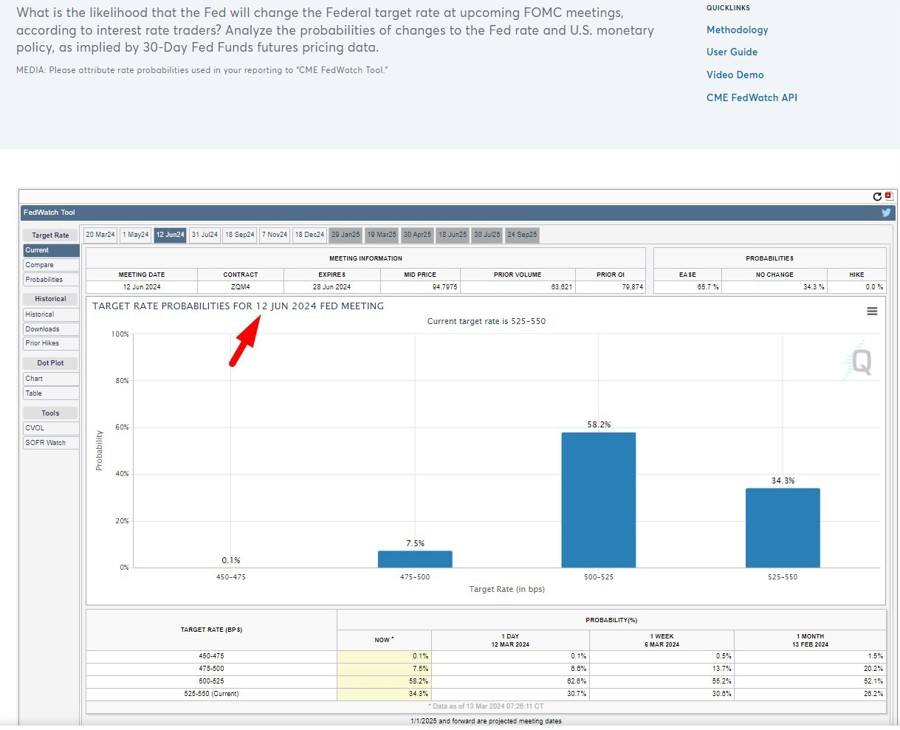

Next week, the Federal Open Market Committee (FOMC) is set to meet, and there is a growing concern regarding the possibility of a more hawkish view from the Federal Reserve. A snippet from Bank of Montreal suggests that there is a risk leaning towards a more hawkish stance.

According to the Bank of Montreal, the current market bias is in favor of a rate cut in June. However, there is a recognition that this could change based on the upcoming update on the Summary of Economic Projections (SEP), especially if there is a shift towards higher inflation and fewer expected rate cuts.

Implications for Individuals

For individuals, a more hawkish stance from the Federal Reserve could have various implications. One potential impact is on interest rates, as a more hawkish approach could lead to less accommodative monetary policy. This could result in higher borrowing costs for consumers, including on mortgages, auto loans, and credit cards.

Furthermore, a more hawkish stance could also impact financial markets, with potential fluctuations in stock prices and bond yields. This uncertainty could influence investment decisions and overall financial planning for individuals.

Global Impact

The Federal Reserve’s shift to a more hawkish stance could also have significant implications on a global scale. A more hawkish outlook from the Fed could lead to a stronger U.S. dollar, which could affect exchange rates and trade balances with other countries.

Additionally, changes in U.S. monetary policy could have spillover effects on global financial markets and economies. For emerging markets and developing countries, a more hawkish stance could result in capital outflows and increased volatility in their local currencies and assets.

Conclusion

In conclusion, the potential for a more hawkish view from the Federal Reserve raises concerns for both individuals and the global economy. It is important to closely monitor the upcoming FOMC meeting and any updates on the SEP to gauge the direction of U.S. monetary policy and its implications.