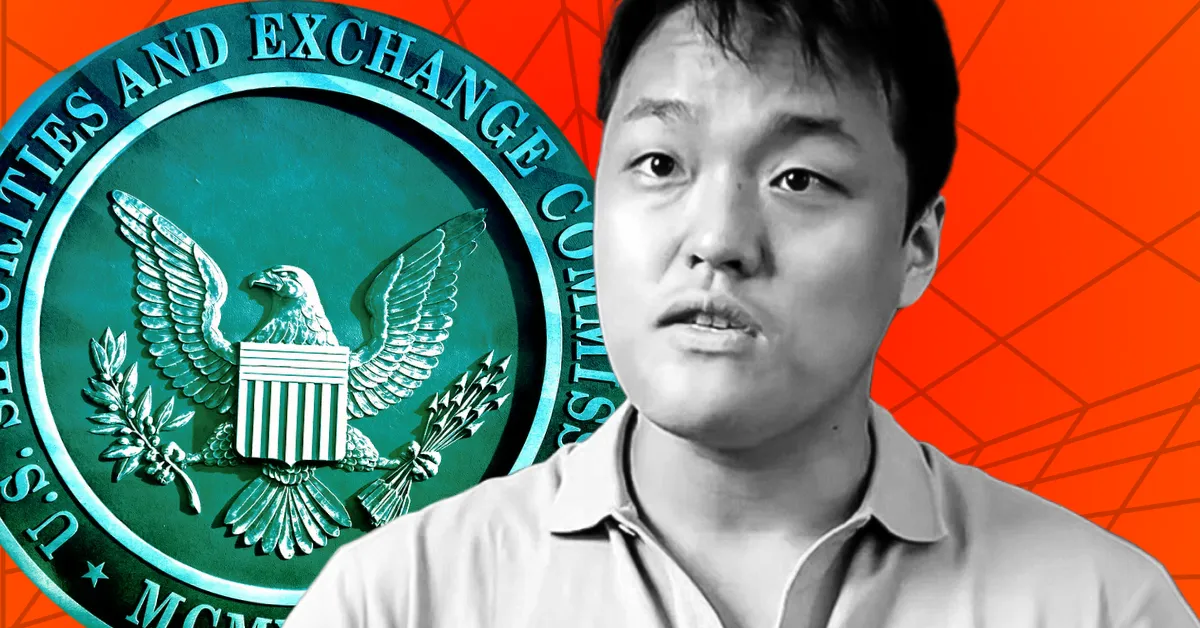

SEC Raises Alarm Over Terraform Labs’ $166M Payment to Dentons Amid Bankruptcy

Financial Maneuvers Under Scrutiny

The U.S. Securities and Exchange Commission (SEC) has recently expressed concerns regarding Terraform Labs’ financial activities, particularly in relation to a $166 million payment made to law firm Dentons. The SEC has urged the Delaware bankruptcy court to closely examine this transaction, citing it as a potentially questionable move.

According to the SEC, Terraform Labs has conducted a series of financial transactions that have raised red flags. In particular, the transfer of $166 million to Dentons has come under scrutiny, with the SEC suggesting that there may be more to this payment than meets the eye.

It is unclear at this point what the exact nature of the payment to Dentons was for, but the SEC’s concerns have highlighted potential financial irregularities within Terraform Labs. The company’s financial practices and decision-making processes have now come under intense scrutiny, with the SEC seeking further investigation into the matter.

Impact on Individuals

For individual investors and stakeholders in Terraform Labs, the SEC’s concerns raise questions about the company’s financial stability and transparency. The revelation of potentially questionable financial maneuvers could impact investor confidence and have repercussions on the value of Terraform Labs’ assets.

Investors may be wary of continuing to support a company that is facing scrutiny from regulatory authorities, and may choose to divest their holdings in Terraform Labs. This could lead to a decline in the company’s stock price and overall market performance, affecting individual investors who have a stake in the company.

Global Implications

On a larger scale, the SEC’s investigation into Terraform Labs’ financial activities and the $166 million payment to Dentons could have broader implications for the financial industry and regulatory oversight. The case underscores the importance of transparency and accountability in financial transactions, particularly in the context of bankruptcy proceedings.

Regulators around the world may take note of this case and implement stricter controls to prevent similar incidents from occurring in the future. The SEC’s actions could serve as a catalyst for increased scrutiny of financial transactions and payment practices within the industry, leading to greater transparency and accountability across the board.

Conclusion

The SEC’s concerns over Terraform Labs’ $166 million payment to Dentons amid bankruptcy highlight the importance of regulatory oversight and transparency in financial transactions. Individual investors and stakeholders in Terraform Labs may face uncertainty and potential losses due to the ongoing investigation, while the case could have broader implications for the financial industry as a whole.