The Impact of US PCE Data on 10-Year Yield

Introduction

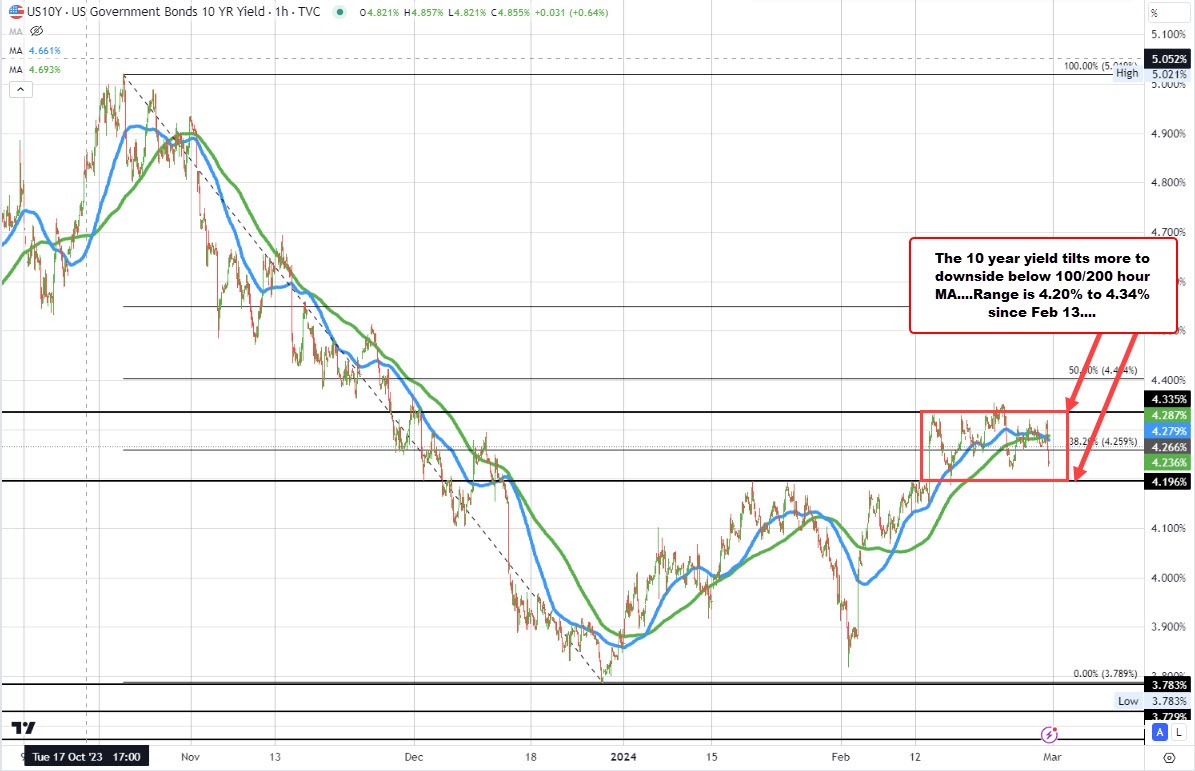

Today, the US 10-year yield has experienced a significant movement following the release of the US Personal Consumption Expenditures (PCE) data. The yield has dropped to a low of 4.225%, currently trading at 4.234%, down by 4.0 basis points for the day. The high yield recorded was 4.319%.

Technical Analysis

The lower movement has brought the yield below its near-converged 100 and 200 hour moving averages, which are indicated by the blue and green lines on the chart. These levels are approximately around 4.27%. Upon reviewing the hourly chart, it is evident that the yield has been fluctuating between 4.20% and 4.33% since February 13, with a brief break above the high.

With the current situation, investors are closely monitoring the impact of the US PCE data on the 10-year yield and how it will influence the financial market.

Effect on Individuals

For individual investors, the decrease in the 10-year yield may result in lower interest rates on various financial products, such as mortgages and savings accounts. This could potentially make borrowing more affordable for those looking to invest in real estate or other assets.

Effect on the World

The movement in the US 10-year yield can have a global impact on the financial market. Lower yields may attract foreign investors to US securities, leading to an influx of capital into the country. This could strengthen the US dollar and influence international trade and investments.

Conclusion

In conclusion, the recent shift in the US 10-year yield following the release of the PCE data has sparked interest among investors and analysts. The fluctuation in the yield can have significant implications for individuals and the global economy, shaping investment strategies and financial decisions in the coming days.