EURJPY Falls Slightly After Meeting 3-Month High

EURJPY creates bullish tendency in short- and long-term timeframes

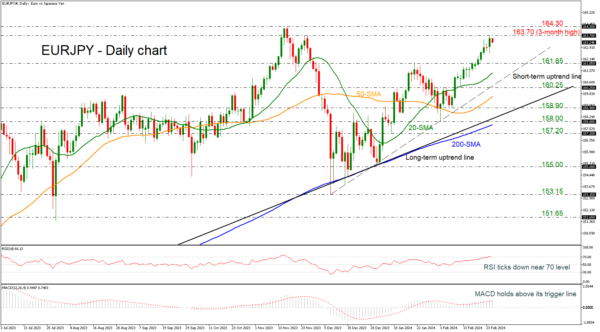

EURJPY is retreating somewhat after the aggressive buying interest towards the three-month high of 163.70. The price has been developing an upward trend since the rebound off the 153.15 support level confirming the bullish bias in the short- and long-term pictures.

RSI indicates potential downside retracement

Technically, the RSI indicator…

EURJPY has been making waves in the forex market with its recent bullish momentum. Traders have been closely watching the currency pair as it continues to show strength in both short- and long-term timeframes. The recent retreat from the three-month high of 163.70 has sparked some concerns, but overall, the bullish bias remains intact.

The RSI indicator is suggesting a potential downside retracement, which could offer opportunities for traders to enter the market at more favorable levels. Despite the current pullback, the overall trend is still bullish, and many analysts believe that EURJPY has the potential to continue its upward trajectory in the near future.

As a trader, the falling slightly of EURJPY after meeting the 3-month high could impact your trading decisions. It is important to closely monitor the price action and technical indicators to determine the best entry and exit points. The potential downside retracement indicated by the RSI could present buying opportunities for those looking to go long on the currency pair.

On a larger scale, the movement of EURJPY could have implications for the global economy. A strong EURJPY could indicate confidence in the Eurozone economy, while a falling EURJPY could raise concerns about the health of the European economy. Traders and investors around the world will be paying close attention to the fluctuations in the currency pair, as it could signal broader trends in the forex market.

Conclusion

In conclusion, while EURJPY has fallen slightly after meeting the 3-month high, the overall bullish bias remains intact. Traders should continue to closely monitor the price action and technical indicators to capitalize on potential buying opportunities. The movement of EURJPY will not only impact individual traders but also have implications for the global economy as a whole.