Is an ECB Rate Cut on the Horizon?

Centeno’s Message to Policymakers

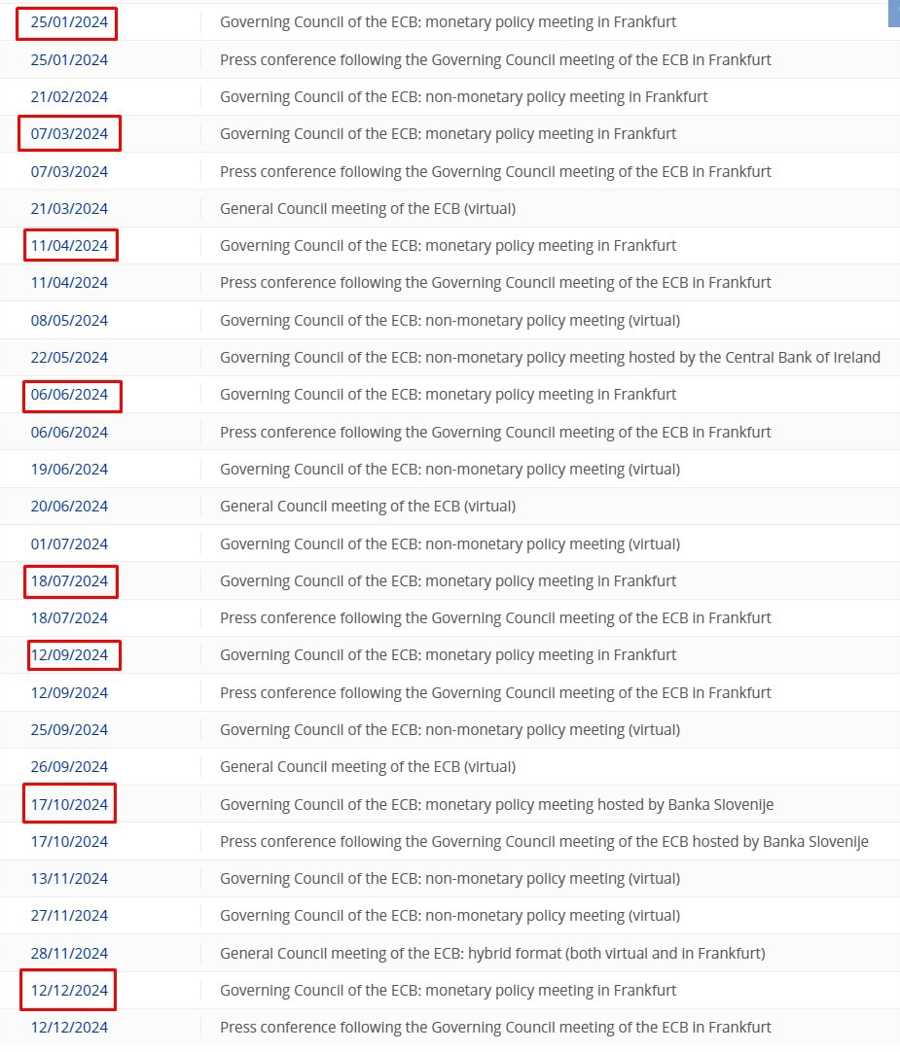

Centeno spoke on Friday and he conveyed the message that while he though a March ECB rate cut is unlikely, policymakers must be open to it.

“March is the date when we have the largest amount of new data in front of us — some data may tell us to discuss interest rate cuts as soon as March”

“I’m not saying that it is likely, but we have to be open”

“We need to look at the data”

“Inflation has been consistently below our forecasts in recent months — and growth as well … This is a sign that the down…”

Centeno Urges Caution

While the possibility of an ECB rate cut in March may not seem imminent, Centeno’s words serve as a warning to policymakers that they must be prepared to consider all options. In a time of economic uncertainty, remaining open to changes in interest rates is crucial for maintaining stability.

Centeno’s emphasis on data-driven decision making highlights the importance of monitoring economic indicators closely. With inflation and growth below expectations, it is clear that there are challenges ahead that cannot be ignored.

Ultimately, the message is clear: policymakers must be proactive in addressing economic challenges and be willing to adapt to changing circumstances.

How Will This Decision Affect Me?

An ECB rate cut could have a direct impact on consumers and businesses alike. Lower interest rates could mean cheaper borrowing costs, making it easier for individuals to take out loans for big purchases like homes or cars. Additionally, businesses may benefit from lower borrowing costs, leading to increased investment and potentially job creation.

However, a rate cut could also have negative effects, such as lower returns on savings and investments. For those relying on interest income, a rate cut could mean reduced earnings and financial uncertainty.

How Will This Decision Affect the World?

Global markets are closely watching the ECB’s decisions, as the eurozone’s economic performance has far-reaching implications. A rate cut in March could lead to increased volatility in financial markets, as investors react to changing interest rate policies.

Furthermore, a rate cut could impact countries outside of the eurozone, as changes in European interest rates can influence global economic trends. This interconnectedness highlights the importance of coordinated efforts to address economic challenges on a global scale.

Conclusion

Centeno’s remarks serve as a reminder of the importance of flexibility and readiness in economic policymaking. While a March ECB rate cut may not be imminent, the need for vigilance and data-driven decision making is clear. As we navigate through uncertain economic times, policymakers must be prepared to adapt to changing circumstances and consider all available options.