Will the RBNZ Cry Wolf Again?

Introduction

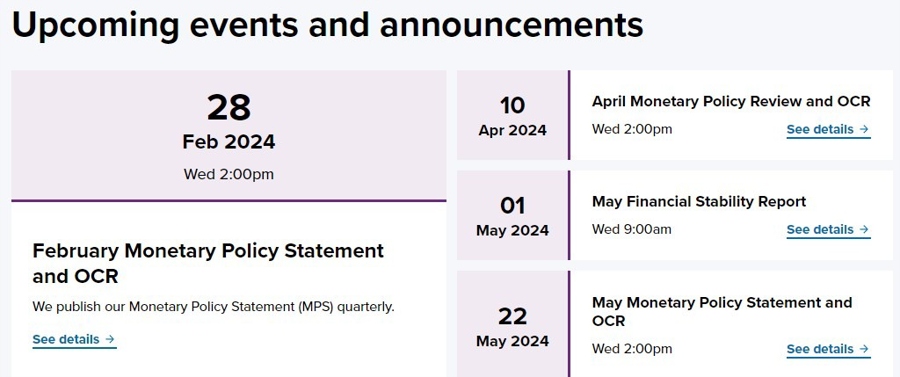

The Reserve Bank of New Zealand (RBNZ) is set to make a decision on interest rates in the upcoming week. With inflation below the target level of 2%, the RBNZ is under pressure to take action to stimulate the economy. Will they opt to hold rates steady or will they decide to raise them?

Current Situation

The RBNZ has been vocal about the need to keep inflation in check and has warned households and businesses about the risks associated with rising prices. Their current cash rate stands at 5.5%, a relatively high level that reflects their commitment to combatting inflation.

Expectations

Given the RBNZ’s track record of caution, it is likely that they will hold the cash rate at 5.5% in the upcoming decision. This decision would align with their strategy of maintaining pressure on the economy until inflation reaches the target level.

Impact on New Zealand

If the RBNZ does decide to raise interest rates, it could have a significant impact on businesses and households in New Zealand. Higher rates could lead to increased borrowing costs, which may dampen consumer spending and investment activity. On the other hand, keeping rates steady could provide some stability for the economy in the short term.

Impact on the World

The decision made by the RBNZ could also have repercussions beyond New Zealand’s borders. Changes in interest rates in one country can affect global financial markets, particularly in terms of currency exchange rates and interest rate differentials. Investors around the world will be paying close attention to the RBNZ’s decision and its potential impact on the global economy.

Conclusion

As the RBNZ prepares to make its decision on interest rates, it is clear that the stakes are high. Whether they choose to hold rates steady or raise them, the impact will be felt not only in New Zealand but also on the global stage. Businesses and individuals alike will be watching closely to see how the RBNZ’s decision will shape the economic landscape in the coming months.